Institutional curiosity in cryptocurrencies is rising, as revealed by a current Coinbase survey. What is going on, and what’s inflicting the surge?

Through the years, the crypto market has seen a shift in the direction of institutional adoption of digital property, signaling a section the place crypto property are getting more and more built-in into the broader monetary ecosystem.

A survey performed by Coinbase in Nov. 2023 revealed that institutional curiosity in crypto investments is on the rise. About one-third of respondents elevated their crypto holdings over the previous yr, whereas solely 17% decreased them. Half of the respondents stored their crypto investments unchanged.

Their findings additionally revealed that 64% of these already invested in crypto anticipate that their agency’s allocations will improve over the following three years. Apparently, not one of the respondents anticipated a lower of their allocations throughout this era.

So, what do these findings imply for the crypto market, and what are the important thing takeaways relating to institutional adoption in crypto?

Institutional adoption traits and highlights

Institutional adoption of crypto is hitting milestones, displaying how digital property have gotten extra built-in into finance. Let’s delve into the main traits and updates.

Spot BTC ETF approvals and prospects for ETH ETFs

The approval of 11 spot Bitcoin (BTC) ETFs by the U.S. SEC got here as a historic resolution after years of anticipation and a number of other purposes from main monetary establishments.

Among the many accredited ETFs are these by notable monetary giants corresponding to Grayscale, Constancy, and BlackRock, signaling sturdy institutional backing in offering regulated Bitcoin funding automobiles to a broader viewers.

Moreover, the institution of those ETFs on main U.S. exchanges enhances the legitimacy and perceived stability of Bitcoin as an asset class, probably resulting in elevated adoption by each retail and institutional buyers.

Inside only a month, these ETFs have amassed over $25 billion in collective property beneath administration (AUM), in line with information from Blockworks.

The SEC’s resolution additionally units a precedent for the approval of different cryptocurrency-based monetary merchandise, together with these tied to different digital property like Ethereum (ETH).

In a SEC filing from Feb. 6, it’s revealed that the regulatory physique has postponed its resolution on a proposed product by Invesco and Galaxy Digital, main gamers in asset administration and crypto, respectively.

This delay isn’t remoted. All through the years, the SEC has been pushing again choices on varied spot Ethereum ETF purposes. Notable names like BlackRock and Constancy are among the many corporations awaiting approval.

Bloomberg analyst James Seyffart suggests the SEC will initially reject spot Ethereum ETFs however could in the end approve them by the Might 23 deadline this yr.

The ETF pattern suggests wider recognition and adoption of cryptocurrencies inside institutional circles, probably paving the best way for broader acceptance and funding within the digital asset area.

JP Morgan’s programmable funds

In Nov. 2023, JPMorgan Chase introduced a brand new perform for its blockchain platform, JPM Coin, geared toward its institutional shoppers. This perform, often known as programmable funds, permits customers to automate and execute monetary transactions primarily based on particular circumstances, providing a versatile method to managing funds and treasury features.

The essence of programmable funds lies of their use of smart contracts to automate transaction processes. Because of this transactions will be set to happen routinely when sure predefined circumstances are met, corresponding to reaching a sure date or fulfilling a contractual time period.

For instance, Siemens AG, a multinational firm, turned one of many first to make use of this characteristic, indicating its sensible worth for big companies.

Canton Community by Goldman Sachs and others

In Might 2023, a consortium led by thirty outstanding monetary establishments, together with Goldman Sachs, Microsoft, BNP Paribas, Deloitte, and others, announced the launch of the Canton Community.

The Canton Community is designed as an interoperable blockchain “community of networks,” facilitating the tokenization of real-world property (RWAs) utilizing Digital Asset’s DAML language.

The significance of the Canton Community lies in its give attention to RWAs, which embody a variety of property, from conventional monetary devices to bodily property that may be digitally represented on a blockchain.

By offering a standardized mechanism for the illustration of real-world property on a blockchain, it opens up new potentialities for asset house owners, buyers, and monetary service suppliers.

These potentialities embody extra accessible funding alternatives, enhanced liquidity, and the potential for creating extra dynamic and responsive monetary merchandise.

How can crypto acquire extra institutional adoption?

The components resulting in extra establishments adopting crypto and blockchain in 2024 are multifaceted. Let’s perceive them one after the other:

Tech improvements

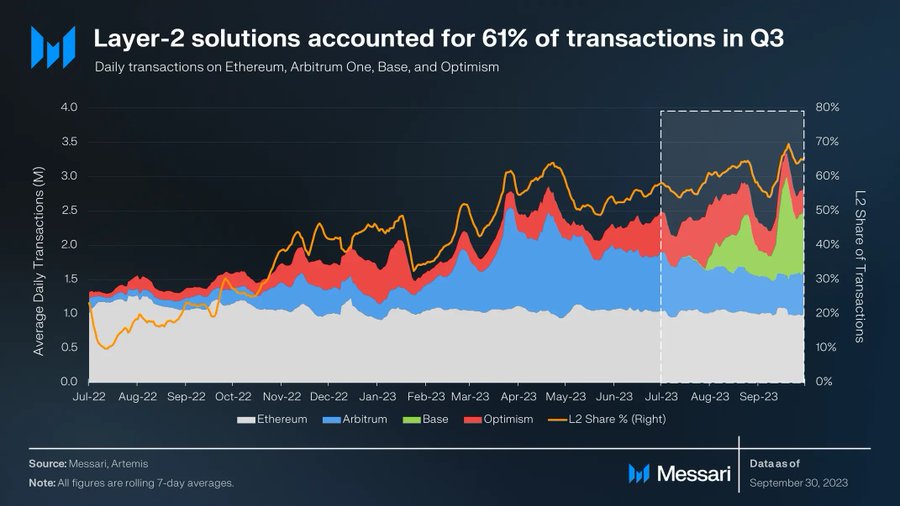

The development of blockchain, notably by way of creating and adopting layer-2 scaling options and modular blockchains, is an important issue within the tech panorama.

Layer-2 options, which intention to boost scalability, effectivity, and cost-effectiveness, skilled notable growth in 2023.

This development in the direction of specialised blockchain infrastructures—tailor-made by sector or perform—might improve blockchain’s enchantment for institutional purposes, leading to newer purposes and use circumstances.

Regulatory developments

2023 witnessed important strides in the direction of regulation, highlighted by the UK government and the European Union announcing plans to enact intensive laws governing crypto actions.

The continuation of this pattern in 2024 is predicted to result in additional rules, enhancing readability and probably boosting institutional adoption.

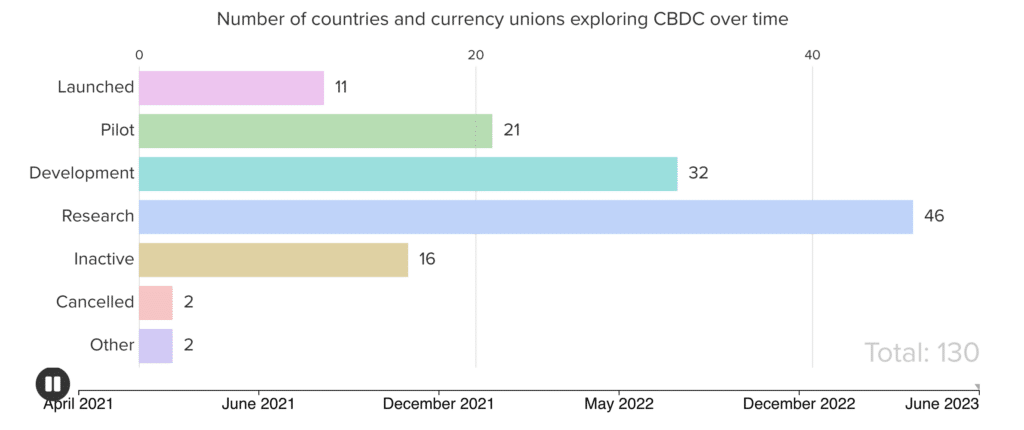

Central financial institution digital currencies (CBDCs)

The push for CBDCs continues to realize momentum into 2024, with a number of main central banks both exploring or already implementing CBDCs.

The Financial institution for Worldwide Settlements forecasts the introduction of as much as 15 retail and 9 wholesale CBDCs by 2030.

The profitable rollout of CBDCs requires complete infrastructure and frameworks, encouraging collaboration amongst establishments.

Cross-border funds

Monetary establishments and banks are adopting crypto and blockchain expertise for cross-border payment options, drawn by its capability to facilitate extra environment friendly and cost-effective transactions.

With main firms and cost establishments leveraging blockchain to innovate and improve their service choices, monetary giants and establishments might uncover new use circumstances to enhance their companies.

FAQs

What’s the institutional adoption of crypto?

Institutional adoption of crypto means large firms like funding corporations and companies are beginning to use blockchain and digital property of their monetary plans. They’re seeing crypto as a invaluable a part of their investments, they usually’re placing more cash into it and planning to take a position much more sooner or later.

Which crypto is most adopted?

Bitcoin is essentially the most adopted cryptocurrency by establishments. That is highlighted by the approval of 11 spot Bitcoin ETFs by the U.S. SEC, which marks an important step in the direction of integrating Bitcoin into mainstream monetary merchandise. The fast accumulation of property beneath administration by these ETFs additional underscores Bitcoin’s main place in institutional adoption.

How are monetary establishments utilizing blockchain?

Monetary establishments use blockchain to streamline and safe their operations, particularly in cross-border funds. Blockchain gives sooner, extra environment friendly, and cheaper transaction processes in comparison with conventional strategies. Examples embody JPMorgan’s introduction of programmable funds for automated transactions and the Canton Community’s give attention to tokenizing real-world property, demonstrating blockchain’s broad applicability in modernizing monetary companies.