Bitcoin surged to $50,000, marking its highest level in over two years.

Because the starting of final yr, Bitcoin’s worth has seen a threefold enhance, rebounding from a major 64% drop in 2022. The final occasion Bitcoin reached the $50,000 milestone was in December 2021, although it nonetheless has not surpassed its peak of practically $69,000 from November 2021.

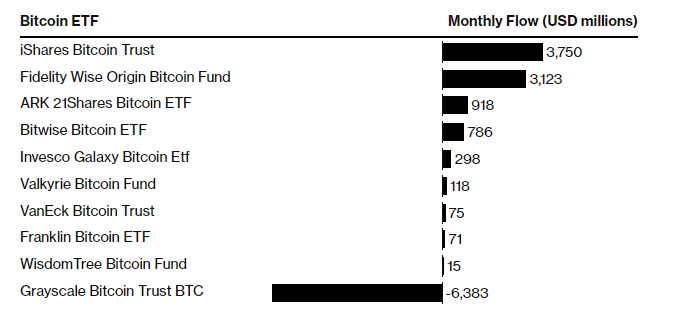

This surge comes from a optimistic Bitcoin ETF market, as the brand new funds have attracted over $8 billion in inflows inside only a month of buying and selling. Regardless of Grayscale’s Bitcoin Belief experiencing giant outflows all through January, these withdrawals have stabilized, and spot Bitcoin ETFs at present maintain round $2.8 billion in internet belongings.

This revival additionally aligns with a renewed urge for food for danger amongst broader monetary market traders, spurred by anticipations that the Federal Reserve might quickly soften its financial coverage stance. Usually, the prospect of upper rates of interest diminishes the enchantment of riskier investments, together with cryptocurrencies.

Bitcoin’s newest value achievement has successfully erased the losses it suffered following the collapse of the TerraUSD stablecoin in Could 2022. This occasion triggered a domino impact of failures throughout the crypto trade, culminating within the downfall of Sam Bankman-Fried’s FTX change in November 2022.

With BTC reaching $50,000 once more, there’s better optimism surrounding the most important cryptocurrency, particularly with the following halving set to happen in April. A latest survey by crypto change BItget confirmed that 70% of traders globally intend to extend their crypto investments in 2024, and 84% anticipate BTC to surpass its all-time excessive this yr.

Bitcoin’s value dynamics could also be intriguing post-halving if such optimistic market sentiment stays robust.