The worldwide crypto market and the main cryptocurrency, Bitcoin (BTC), registered a slight decline because the U.S. Shopper Value Index (CPI) information exceeded expectations.

Based on data from the CME Group, the CPI annual price dropped from 3.4% to three.1% whereas the anticipated price was 2.9%. Because the inflation price outmatched the expectations, the Federal Open Market Committee (FOMC) didn’t change the rates of interest — presently at 5.25% to five.50%.

The subsequent FOMC assembly is anticipated to happen on March 20 and information from the CME Group means that the likelihood of not altering the rates of interest has risen to 89.5% whereas the remaining 10.5% imagine the committee would ease the rates of interest.

The crypto market confirmed bearish sentiment towards the unchanged rate of interest. Based on information offered by CoinGecko, the worldwide crypto market capitalization declined by 0.3% previously 24 hours and is presently standing at $1.95 trillion.

Furthermore, Bitcoin additionally registered a 0.8% fall over the previous day and is buying and selling at $49,600 on the time of writing. The each day buying and selling quantity of BTC plunged by 13%, presently hovering round $34 billion.

Notably, the flagship crypto asset recorded an intraday low of $48,470 just a few hours after the CPI report was launched.

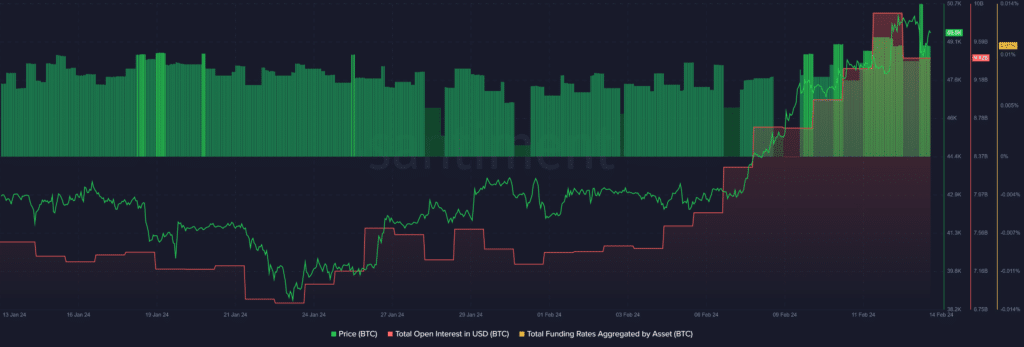

Based on information offered by Santiment, Bitcoin’s whole open curiosity (OI) declined from $9.9 billion to $9.4 billion, exhibiting a roughly $500 million fall.

Information from the market intelligence platform exhibits that the whole funding price aggregated from all exchanges declined from 0.014% to 0.01% following the FOMC assembly. This exhibits that merchants betting for an extra value surge have barely declined because the market sees bearish sentiment.

Per a crypto.information report on Feb. 13, Bitcoin possibility trades which can expire on March 29 count on the asset to reach new all-time highs — merchants are hitting costs of $60,000, $65,000 and even $75,000.