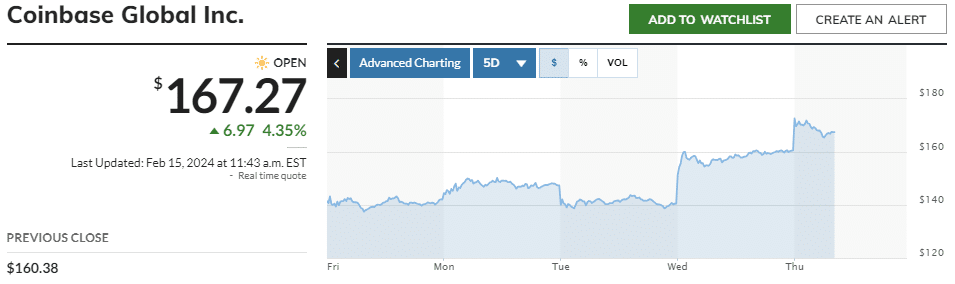

Coinbase International Inc. skilled a 17% improve this week following optimistic reassessments of the corporate’s monetary energy by a number of analysts.

In line with Bloomberg, JPMorgan’s analyst Kenneth Worthington reversed his beforehand adverse stance on the corporate’s shares after Bitcoin’s worth spiked over $50,000 earlier this week, reaching its highest stage since 2021. Worthington revisited his earlier downgrade from January, transferring his suggestion to a impartial place from underweight.

His preliminary downgrade was primarily based on a perception that Bitcoin ETFs’ pleasure may wane, a prediction that didn’t materialize as these funds have carried out nicely in key buying and selling features.

One other common analyst, John Todaro from Needham & Co., has projected that Coinbase will report a internet revenue of $103 million for the fourth quarter. Primarily based on a Bloomberg survey, this forecast stands in distinction to the expectations of many different analysts, who had anticipated a loss for the corporate, round $16 million, or 5 cents per share.

Coinbase’s profitability tends to extend in bull markets resulting from heightened buying and selling exercise from each retail and institutional traders, which raises charge revenue. The quarter noticed Bitcoin’s value escalate by practically 60%, concluding final 12 months with a 157% improve within the cryptocurrency’s worth.

The uptick got here forward of the introduction of spot Bitcoin ETFs. The long-term influence of those ETFs on Coinbase’s enterprise mannequin continues to be unsure. The corporate has beforehand confronted challenges when buying and selling volumes dipped throughout the trade.

Coinbase has been unprofitable for the reason that crypto winter began in early 2022, following the collapse of Terra Luna and Sam Bankman-Fried’s FTX. This led to the most important alternate within the U.S. shedding tons of of workers.