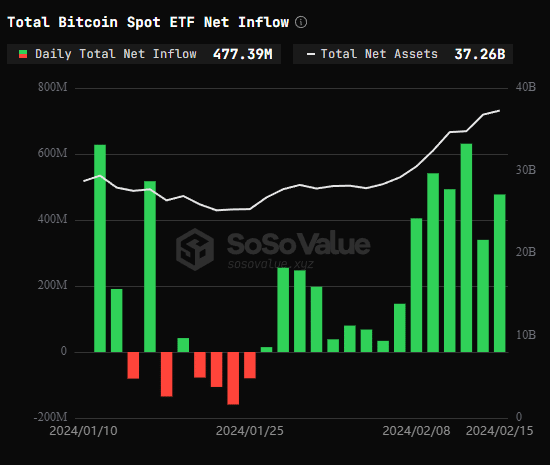

Bitcoin ETFs skilled a complete web influx of $477 million on Feb. fifteenth, persevering with a pattern of constructive web inflows for the fifteenth consecutive buying and selling day.

In response to information from SoSoValue, the Grayscale ETF, GBTC, diverged from this pattern with a web outflow of $174 million for the day. In distinction, BlackRock’s Bitcoin spot ETF, IBIT, led the market with a every day web influx of $330 million, bringing its whole historic web influx to $5.17 billion.

The surge in investor confidence was notably evident on Feb. thirteenth, which recorded the best single-day web influx at $631.2 million. The web influx for Bitcoin ETFs has reached $4.7 billion, indicating a powerful and sustained curiosity in Bitcoin as an funding asset.

The every day buying and selling quantity continues to be being led by BlackRock’s IBIT and Grayscale’s GBTC. Constancy’s FBTC has the second-largest web influx at $3.65 billion and is third in every day buying and selling quantity.

Within the context of ETFs, web influx refers back to the whole worth of money and securities flowing into the fund minus the worth flowing out. A constructive web influx signifies that extra money is invested into the ETF than withdrawn. That is typically seen as a constructive indicator for the ETF, suggesting rising investor confidence and demand.

For Bitcoin and cryptocurrency markets, important web inflows into Bitcoin ETFs are seen as probably constructive, reflecting elevated institutional and retail funding by means of regulated monetary merchandise.