Bitcoin and Ethereum led cryptocurrencies in liquidations as over 54,000 merchants noticed leveraged positions worn out, and the overall market cap neared $2.1 trillion.

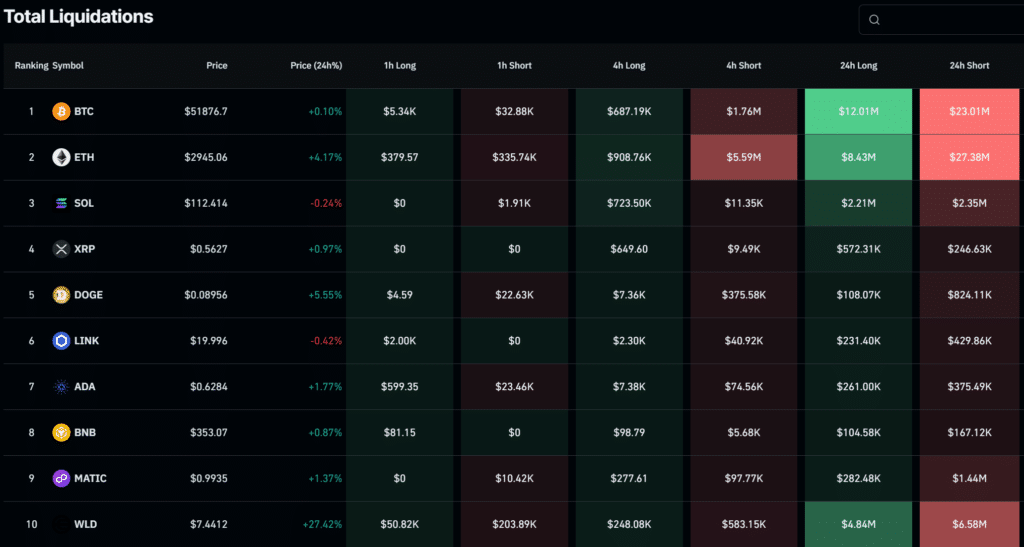

CoinGlass reported that over $145 million was liquidated from the crypto market in 24 hours throughout exchanges. As most merchants anticipated decrease costs, $91 million of those trades have been registered as brief positions.

Nonetheless, the overall cryptocurrency market cap rose 1.2% per CoinGecko and liquidated the draw back bets. A $4 million Bitcoin (BTC) place in a USDT pairing made the only largest liquidation order. The commerce was on Binance, crypto’s greatest alternate.

Merchants additionally misplaced a minimum of $70 million mixed between BTC and Ethereum (ETH) throughout lengthy and brief punts.

Bitcoin, Ethereum transfer up

BTC and ETH, the highest cryptocurrencies by market cap, have seen value uptrends prior to now week. The tokens have gained 3% and 11% within the final seven days amid bullish market sentiment.

Bitcoin ETF approvals by the U.S. SEC on Jan. 10 appear to be a principal driving power in Bitcoin’s rally because it costs in at $51,800 and holds a market cap of over $1 trillion, making BTC the tenth largest asset on the planet. There’s additionally anticipation surrounding the Bitcoin halving, which is predicted in April.

Some imagine the halving, which slashes new block rewards in half, and BTC acquisitions for spot Bitcoin ETFs will set off a provide crunch whereas demand will increase. The main hypothesis suggests this may trigger a parabolic run for crypto’s largest asset.

Ethereum’s present momentum revolves round a technological improve dubbed Dencun. Builders have stated the modifications will introduce expanded knowledge availability for layer-2 rollups by way of a blob characteristic. This may permit L2s so as to add extra knowledge to every block, thus lowering transaction prices and bolstering scalability.

Dencun is slated to ship to Ethereum’s mainnet round mid-March following profitable testing on three testnets: Goerli, Sepolia, and Holesky.