Ethereum’s native token reached $3,000 on Feb. 20, following a week-long rally as money poured into a number of cryptocurrencies in 2024.

This was the primary time since April 2022 that Ethereum (ETH) hit this degree, reaffirming bullish sentiment towards crypto’s second-largest asset and blockchain. Based on CoinMarketCap, ETH grew greater than 2% within the final 24 hours and over 13% up to now seven days.

Ethereum now has a market cap above $355 million following the newest enhance, accounting for simply over 18% of crypto’s complete market. Yr-to-date (YTD), ETH is up 30% as effectively.

Ether’s progress has coincided with Bitcoin (BTC) will increase and the entire cryptocurrency panorama. Bitcoin has skilled elevated demand after the U.S. SEC allowed spot BTC ETFs to commerce on nationwide exchanges, just like the NASDAQ and CBOE.

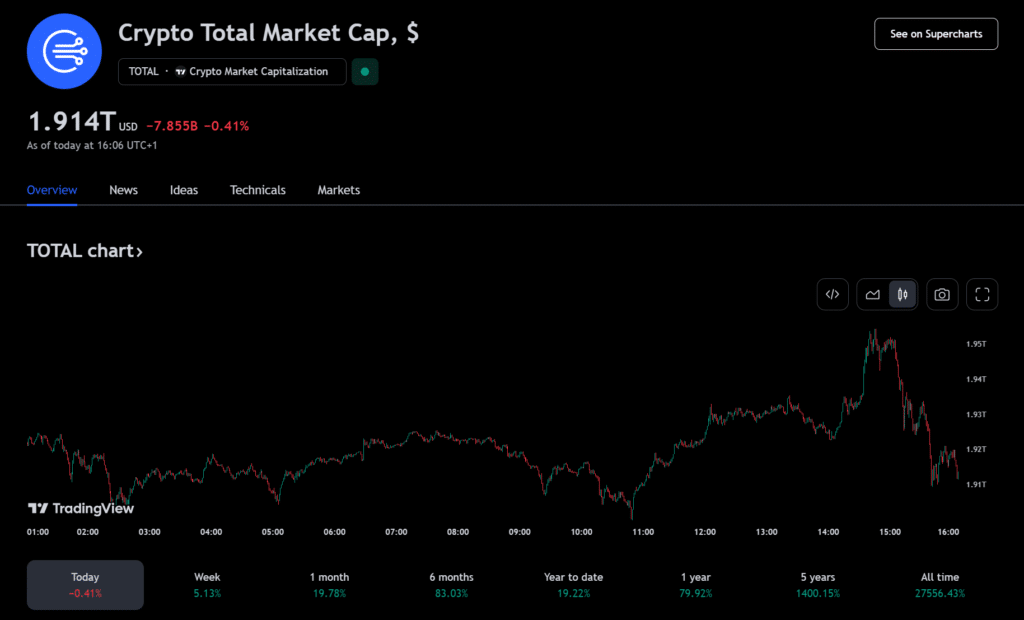

Some analysts pointed to identify Bitcoin ETFs as a catalyst for broad curiosity in crypto markets. TradingView information backs up this narrative, as crypto’s market cap has expanded by practically 20% two months into the yr.

Ethereum’s ETF momentum

Issuers are additionally gunning for a similar product, with ETH because the underlying asset. As crypto.information reported, a number of issuers from ARK 21Shares to Invesco Galaxy have filed purposes to listing spot Ethereum ETFs on U.S. exchanges.

These merchandise exist already in futures contracts, which observe forthcoming Ether costs relatively than spot costs. The SEC has sometimes denied crypto spot-based merchandise, citing market manipulation and fraud issues, however Decide Neomi Rao’s ruling within the Grayscale case overturned this tactic.

Decide Rao labeled the SEC’s resolution “arbitrary and capricious”, discovering the choice to approve and deny comparable merchandise insufficient by regulation.

Trade proponents are hopeful that the identical rationale would possibly apply to ETH-based merchandise, though SEC Chair Gary Gensler has sometimes expressed a divergent view. Gensler has but to deal with whether or not Ethereum is a safety or not categorically however insists that the overwhelming majority of cryptocurrencies fall underneath monetary guidelines.

Analysts predict a 50% probability that Ethereum ETFs monitoring spot ETH costs obtain the regulatory nod within the second quarter of 2024.

The SEC has delayed approving or denying spot Ethereum ETFs till Might, whereas a technological improve continues to gas optimism surrounding the cryptocurrency. ETH builders goal to deploy Dencun to the mainnet earlier than the top of March.

Dencun introduces proto-danksharding, an replace to bolster information availability for layer-2 rollups. The answer will add blobs to on-chain exercise and is touted to cut back fuel charges, making it simpler and cheaper to transact on Ethereum’s ecosystem.