Crypto asset supervisor Grayscale has made a strategic transfer by transferring 3,443.1 Bitcoin, amounting to over $175 million, to an handle related to the Coinbase change.

The most recent transfer was executed in 5 separate transactions to Coinbase Prime, a platform designed to cater to the liquidity wants of establishments.

The switch has sparked vital curiosity inside the monetary and cryptocurrency communities, as Grayscale has been recognized to influence market dynamics considerably. The agency’s resolution to maneuver such a lot of Bitcoin to a liquid change for potential sale comes at a time when the cryptocurrency market is experiencing a mixture of volatility and progress.

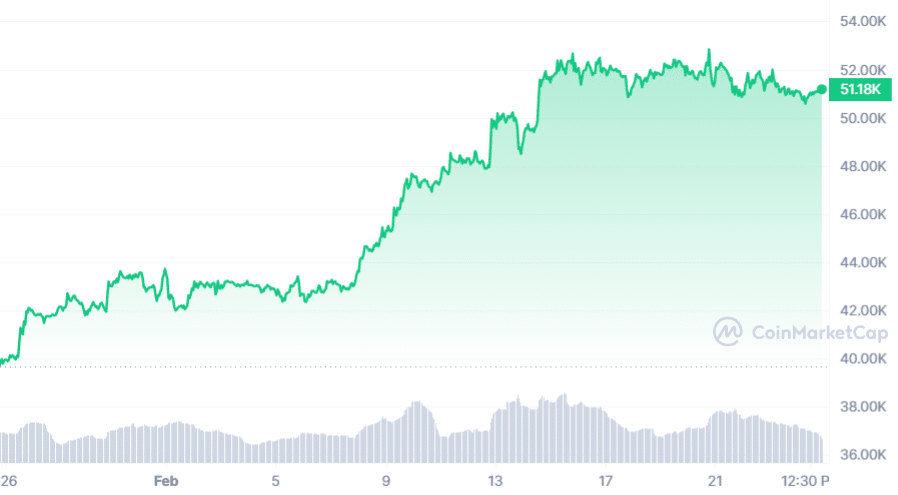

Bitcoin’s worth has just lately seen a 20% enhance this February, regardless of a slight 2.65% drop over the previous three days, sustaining its worth above the $50,000 mark.

Speculations abound concerning the explanations behind Grayscale’s newest transactions. Some market observers recommend that the transfer might be a part of a technique to capitalize on current market beneficial properties. This idea beneficial properties weight contemplating the extended interval traders have had their investments locked within the fund, making the present market surge, particularly after having a tempting alternative for liquidation.

The timing of Grayscale’s actions additionally coincides with discussions round administration charges inside the digital asset administration sector. Grayscale’s Bitcoin Belief (GBTC) is thought for its comparatively excessive administration price of 1.5%, in stark distinction to opponents like BlackRock’s IBIT, which at the moment expenses a price of 0.12%—though plans are underway to extend this to 0.25% inside the subsequent 12 months.

The disparity in charges performs a vital function in traders’ selections, as decrease charges usually result in greater internet returns over time.

Some commentators have linked the elevated outflows from Grayscale to the actions of Genesis, suggesting that the latter’s sale of GBTC for Bitcoin might be influencing market dynamics.

The angle presents a much less bearish outlook on Grayscale’s future market affect, proposing that the consequences of those transactions may steadiness out because of the nature of the gross sales being in Bitcoin.

Following this vital switch, Grayscale’s holdings now stand at 449,834 Bitcoin, valued at over $23 billion. The agency’s portfolio extends past Bitcoin, with Ethereum (ETH) and Livepeer (LPT) as its second and third-largest holdings, respectively.

Grayscale’s whole asset below administration exceeds $31 billion, encompassing different notable tokens like Uniswap (UNI), Chainlink (LINK), and Avalanche (AVAX).