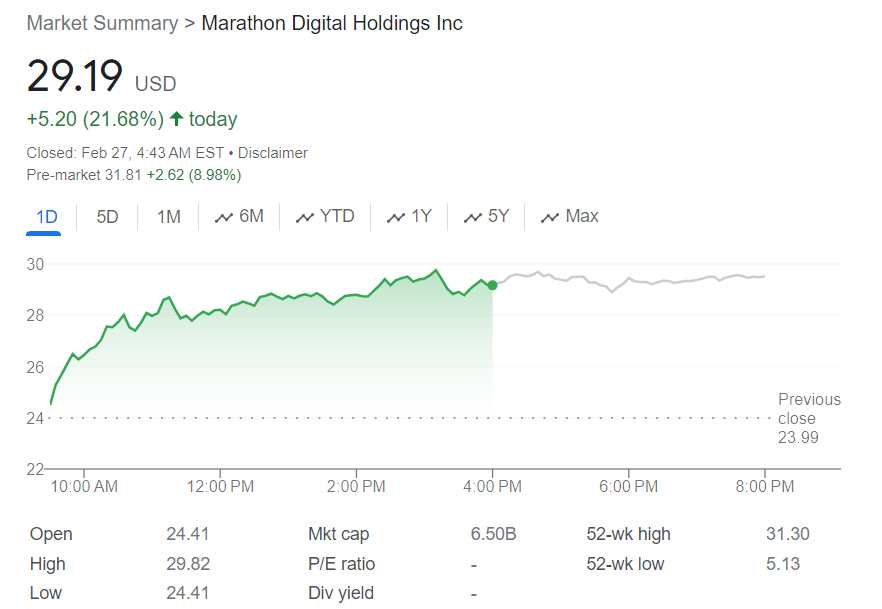

Marathon’s shares surged by greater than 20%, fueled by investor optimism forward of the forthcoming earnings report.

Anticipation surrounding Marathon‘s monetary efficiency, significantly within the wake of Bitcoin’s current worth surge, has fueled vital investor curiosity. The bullish sentiment was evident as Marathon’s inventory (MARA) on Nasdaq surged by 21% to $29 as of Feb. 27, based on information from Google Finance.

Analysts from Zacks Funding Analysis are forecasting This autumn revenues to achieve $138.2 million, reflecting a staggering improve of over 100% in comparison with the identical interval final yr, with a outstanding 385% year-over-year progress.

“Marathon Digital’s efficiency within the quarter is predicted to have been positively impacted by a rise in bitcoin manufacturing and better Bitcoin costs on a year-over-year foundation.”

Zacks Funding Analysis

Based on In search of Alpha analyst Thomas Potter, the upcoming earnings name holds vital significance as it is going to present insights into whether or not the corporate can keep or improve its monetary place. The consensus estimate for MARA’s backside line stands at $0.05 per share, based on Zacks.

Moreover, the forthcoming report is anticipated to underscore Marathon’s readiness for the upcoming halving occasion, which is able to cut back Bitcoin mining rewards by half, from 6.25 BTC to three.125 BTC.

Bitcoin halving happens roughly each 4 years, particularly each 210,000 blocks. This mechanism is intrinsic to Bitcoin’s design to fight inflation and protect its worth over time. In the course of the halving, the reward for mining new blocks is lower in half, lowering the speed at which new Bitcoins are created and, consequently, the overall provide of BTC in circulation.