Two wealth managers on Wall Road will assist spot Bitcoin ETFs almost two months after the merchandise debuted on main U.S. exchanges.

Financial institution of America’s Merrill Lynch and Wells Fargo will permit shoppers with brokerage accounts to commerce spot Bitcoin (BTC) ETFs following billions in demand eight weeks after it turned accessible. Bloomberg first reported the information, citing unnamed sources with intimate data of the matter.

Spot Bitcoin ETF issuers embrace a number of the largest asset managers within the U.S., corresponding to BlackRock and Constancy. Nevertheless, wirehouses and conventional banks initially kept away from providing the product to prospects. Vanguard, Citi Financial institution, and UBS boycotted the Bitcoin-backed funding automobile at launch, crypto.information beforehand reported.

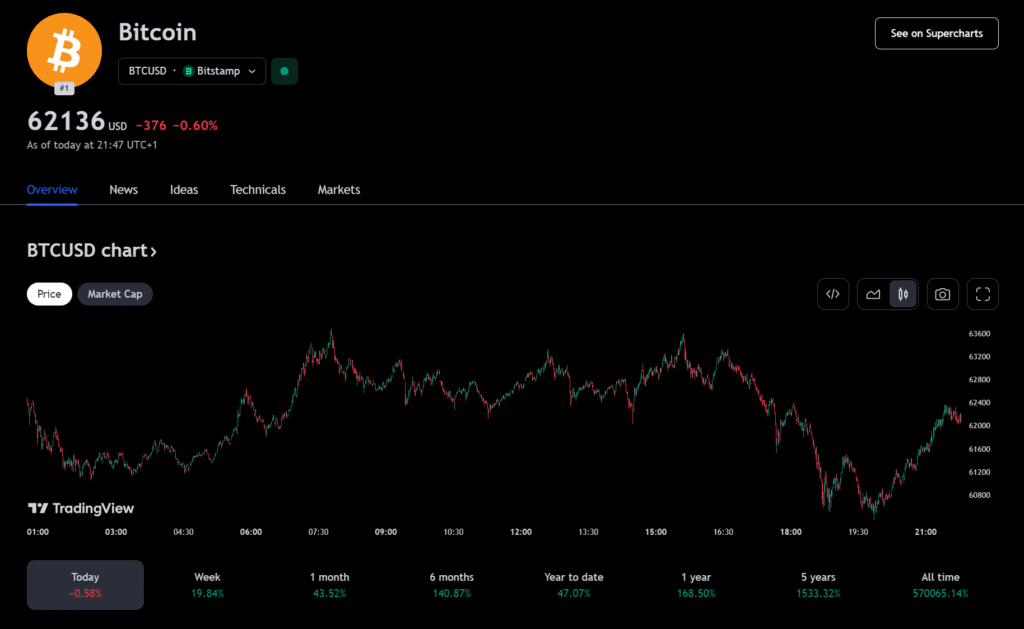

Regardless, spot Bitcoin ETF suppliers have amassed over $20 billion in property beneath administration (AUM) underpinned by growing Bitcoin costs. The token is up almost 50% this 12 months because the ETF wrapper attracts capital from retail buyers, hedge funds, and different capital controllers.

Spot Bitcoin ETFs seize tradfi stakeholders

Citigroup and UBS started permitting choose prospects to buy spot Bitcoin ETFs on platforms in January. Merrill Lynch and Wells Fargo will even provide Bitcoin publicity to shoppers who request it.

One other Wall Road stalwart, Morgan Stanley, is reportedly mulling enabling entry to identify BTC ETF buying and selling for its clientele. Bitwise chief funding officer Matt Hougan advised CNBC that extra tradfi giants would doubtless enter the market, bringing billions of {dollars} in sidelined capital into Bitcoin through ETFs.