Bitcoin spot buying and selling volumes on centralized exchanges returned to peaks final seen when FTX crashed amid day by day sustained demand for ETFs investing in crypto’s prime forex.

Buying and selling volumes for spot Bitcoin (BTC) skyrocketed to a 16-month excessive on Feb. 28, with $34 billion value of cumulative trades on CEXs, in accordance with Kaiko information. Binance was on the forefront of BTC buying and selling on the day and recorded over $17 billion in Bitcoin buying and selling quantity.

Bybit trailed behind at $3.5 billion, whereas Coinbase reached almost $3 billion because the platform experienced a visitors surge and technical difficulties. Coinbase CEO Brian Armstrong mentioned the crypto alternate ready for 10 occasions its ordinary visitors. Nevertheless, this was inadequate to deal with a wave of curiosity within the prime cryptocurrency by market cap.

OKX and Kraken noticed nearly $4 billion in Bitcoin spot buying and selling as BTC surged over 10% past $64,000 earlier than retracing to round $62,000 at press time.

Bitcoin derivatives close to $200 billion in buying and selling

Per Laevitas information, merchants additionally poured capital into crypto by-product merchandise. BTC derivatives loved $182 billion in buying and selling quantity prior to now 24 hours. This accounted for 94% of the $358 billion traded throughout crypto derivatives, together with futures, perpetual contracts, and choices.

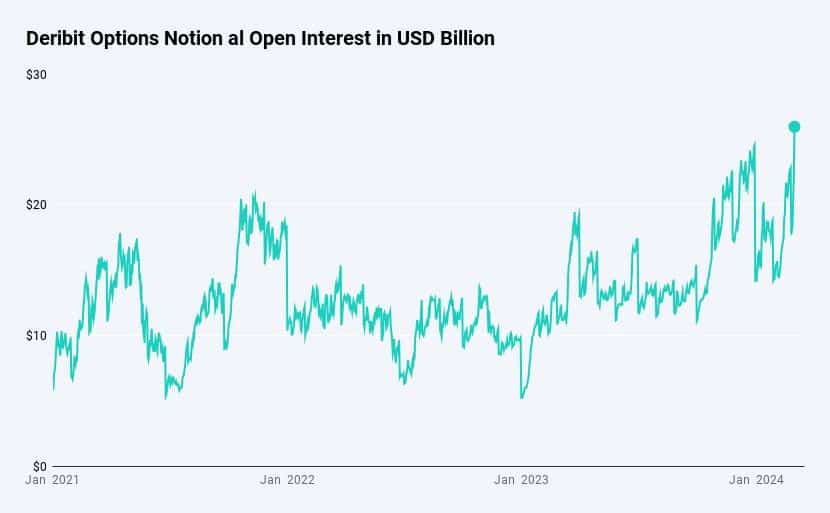

In the meantime, complete notional choices open curiosity hit an all-time excessive of $26 billion on the crypto alternate Deribit, additional confirming huge demand for digital asset derivatives.

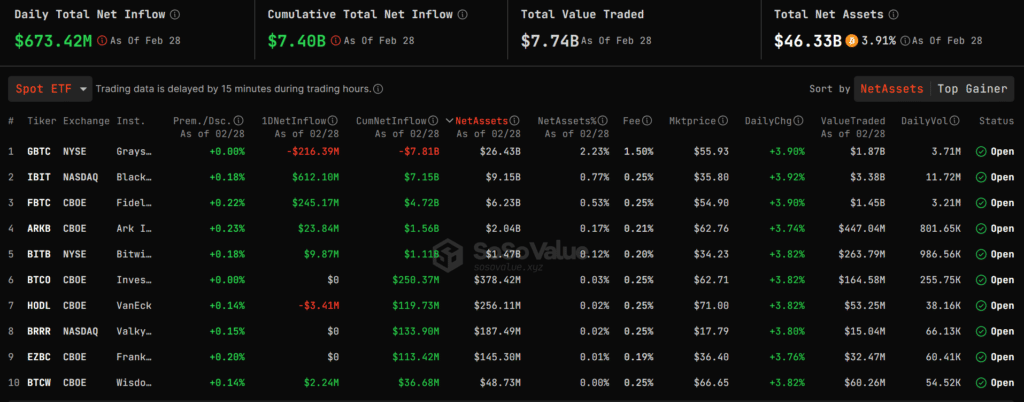

Spot BTC ETFs proceed day by day internet inflows

Spot BTC ETFs logged one other day of internet inflows, with BlackRock main the cost. Of those merchandise, 9 recorded $673 million in complete day by day internet inflows, and BlackRock set a brand new historic excessive of $612 million for a single day, SoSoValue reported.

Grayscale noticed $216 million in outflows because the agency’s transformed GBTC ETF continued to see thousands and thousands in day by day exits. Traders have traded over $7 billion in spot Bitcoin ETFs in lower than two months.