Bitcoin might reclaim its all-time excessive with a 4% surge, and consultants imagine the crypto will develop at the very least thrice its present value throughout this bull run.

Bitget managing director Gracy Chen stated that Bitcoin (BTC) might probably hit $180,000 to $200,000 within the ongoing cycle because of bullish curiosity within the prime cryptocurrency by market cap from institutional stakeholders.

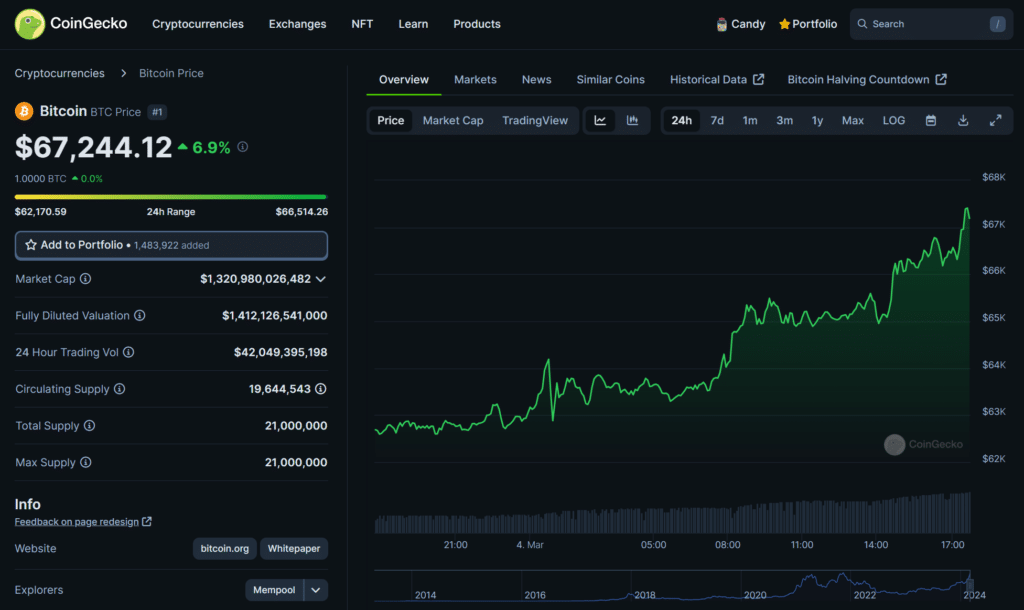

At press time, BTC exchanged palms above $67,200, up over 6% prior to now 24 hours per CoinGecko.

From the latest knowledge on Bitcoin traders, it appears holders are much less delicate to cost volatility and usually see the halving occasion as bullish. So, if Bitcoin ETFs preserve seeing sturdy web inflows this week, likelihood is excessive that we are going to a brand new all-time excessive quickly.

Gracy Chen, Bitget managing director

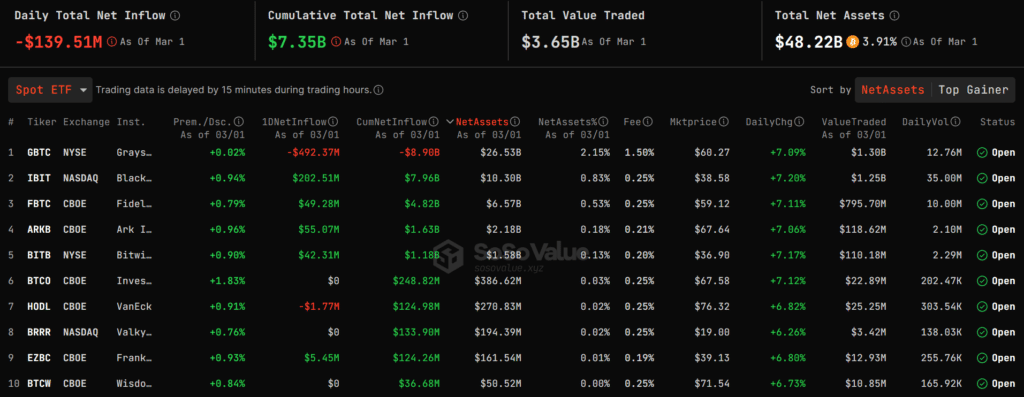

9 spot BTC ETF issuers have attracted over $7 billion in cumulative inflows regardless of Grayscale traders cashing out practically $9 billion from the agency’s transformed GBTC exchange-traded fund, in accordance with knowledge from SoSoValue.

The brand new Bitcoin fund suppliers boast over $20 billion in belongings underneath administration (AUM) and have amassed at the very least 750,000 BTC since buying and selling opened throughout U.S. exchanges on Jan. 11.

The prevailing sentiment amongst analysts and consultants suggests {that a} provide shock is upcoming, notably with the Bitcoin halving anticipated subsequent month. In April, BTC’s community will cut back the reward for mining new blocks by 50%, slashing the speed at which new tokens enter circulation to keep up shortage and tame inflation.

Opinion leaders like Matrixport, Fundstrats Thomas Lee, and Anthony Scaramucci opine that rising demand from spot Bitcoin ETFs coupled with the halving and incoming institutional money ought to set off a parabolic BTC run far above earlier ATH.

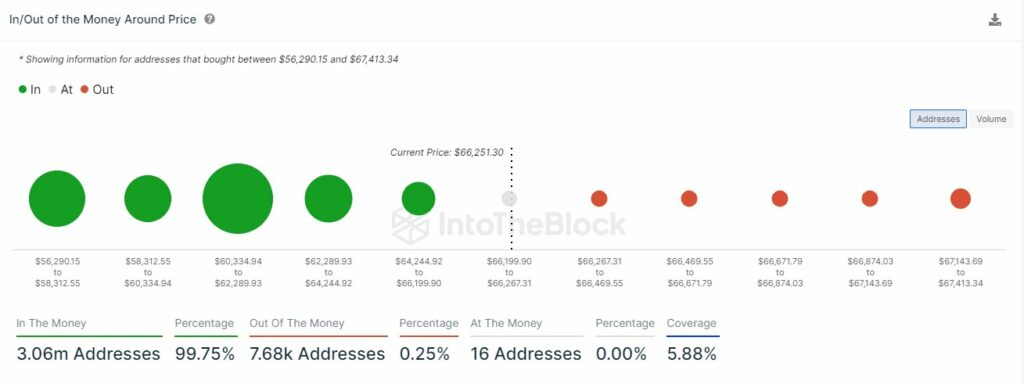

99% of Bitcoin addresses in income

Bitcoin’s surging value has resulted in good points for many holders, as 99.75 of BTC addresses are actually in income per IntoTheBlock knowledge, that means that losses incurred by traders who purchased on the prime of crypto’s earlier bull run have virtually been wholly reconciled.

Fewer than 1% of holders of round 7,680 addresses are at present out of the cash. Nevertheless, holders might see income on their positions ought to BTC push above $67,413 for the primary time since late 2021.