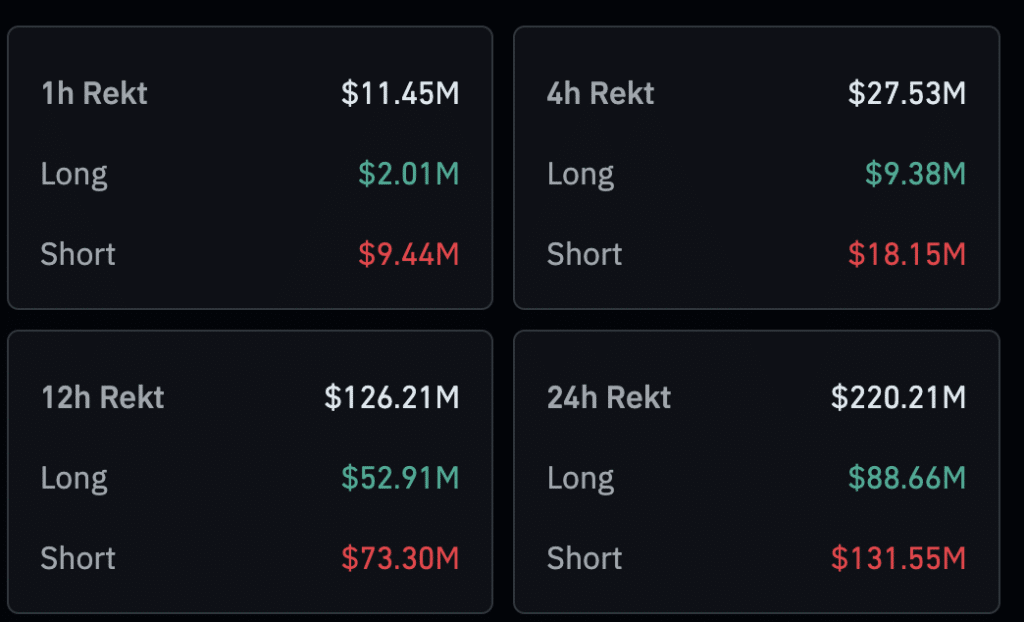

The liquidations of merchants’ positions on main crypto exchanges on account of jumps in cryptocurrency charges over the previous 24 hours exceeded $220 million.

In line with Coinglass, on March 4 most liquidations had been in Bitcoin (BTC), with virtually $60 million. Merchants additionally liquidated positions in Ethereum (ETH) amounting to $26.84 million. It’s noteworthy that merchants actively closed their positions in meme cash, together with Dogecoin (DOGE), Pepe (PEPE), Memecoin (MEME), and Shiba Inu (SHIB). DOGE and PEPE accounted for essentially the most liquidations on this class – $18.12 million and $12.27 million, respectively.

Probably the most important liquidations occurred on the Binance cryptocurrency change for $88.72 million, adopted by OKX which noticed $82.59 million in liquidations.

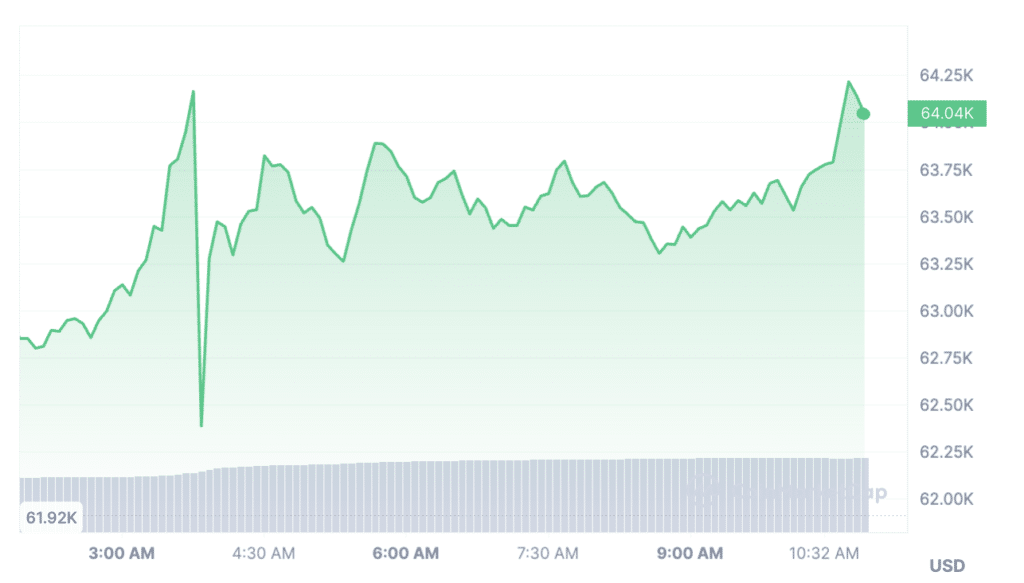

On March 4, the Bitcoin price exceeded $64,000. On the time of writing, BTC is buying and selling at $64,050, having gained virtually 4% over the previous 24 hours. BTC elevated its worth by greater than 24% in only a week.

Matrixport analysts emphasize that the institutional facet is now intertwined with bodily demand. The availability and demand imbalance continues to drive BTC costs greater.

K33 consultants additionally note of their report that Bitcoin exchange-traded funds (ETFs) have emerged as a major matter, significantly regarding their potential to gasoline the BTC worth to surpass its earlier all-time excessive (ATH) of practically $70,000. One other progress driver would be the upcoming halving within the spring of 2024.