MakerDAO, Ethereum’s first defi lending protocol, has captured a 52% share within the ETH lending market.

The milestone was highlighted in Steakhouse Monetary’s MakerDAO Protocol Economics Report for January 2024, which revealed a 22% rise in ETH lending by way of crypto-vaults on Spark.

A lot of MakerDAO’s market dominance all through the previous yr may be attributed to Spark, which has offered excessive liquidity and aggressive borrowing charges for DAI – the most important decentralized stablecoin. Spark is now the third-largest defi lending protocol relating to total value locked (TVL).

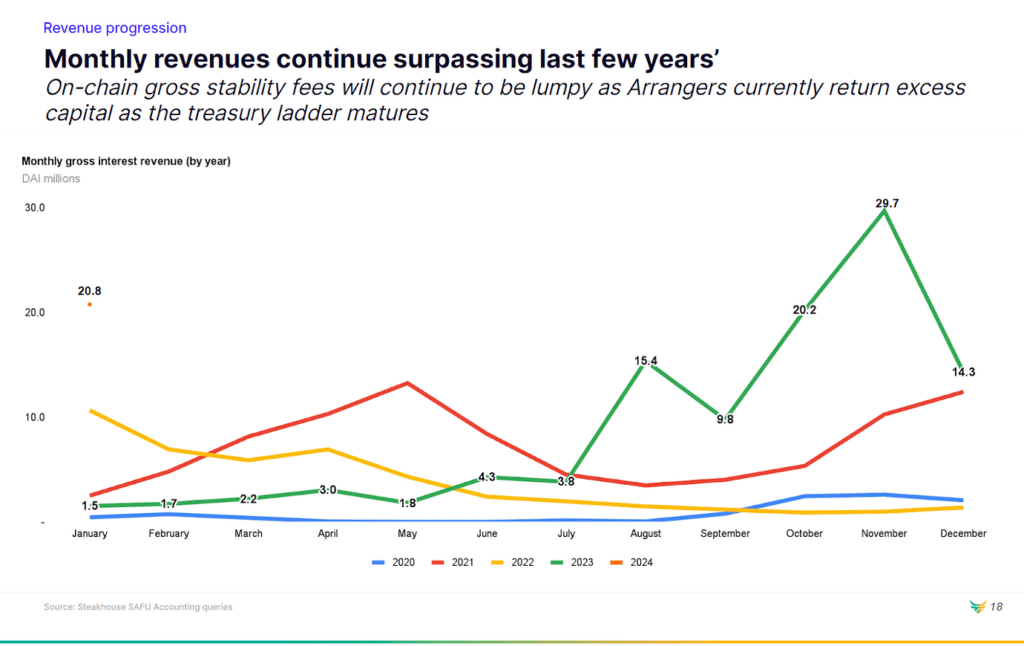

The report particulars MakerDAO’s monetary efficiency, noting a gross month-to-month income of 20.8 million DAI in January 2024. Crypto vaults have been a serious income supply, contributing 10.3 million DAI.

Income from Actual-World Property (RWA) additionally performed a vital position, including 10.5 million DAI to the whole regardless of a 14% lower in RWA publicity in comparison with December 2023.

The shift in the direction of crypto-backed loans from treasury bills has been very important to leveraging the market rally.

MakerDAO continues to evolve with its governance construction by way of the Endgame Plan, aiming to additional decentralize decision-making by introducing SubDAOs. Every SubDAO can have its governance token, course of, and workforce, marking a major step in the direction of a extra decentralized and environment friendly ecosystem.