Bitcoin (BTC) has hit one other all-time excessive, its third since March, and the altcoin market is rising alongside it. Why does this occur?

From the onset of the cryptocurrency period, Bitcoin was synonymous with “cryptocurrency” because of the absence of different digital currencies. Over time, although, 1000’s of latest blockchain tasks have emerged, every with distinctive functions. Regardless of this variety, Bitcoin continues to be the dominant pressure, influencing market traits throughout the cryptocurrency spectrum. This text delves into why and the way altcoins are so intently tied to Bitcoin’s market actions.

Altcoin season and its market affect

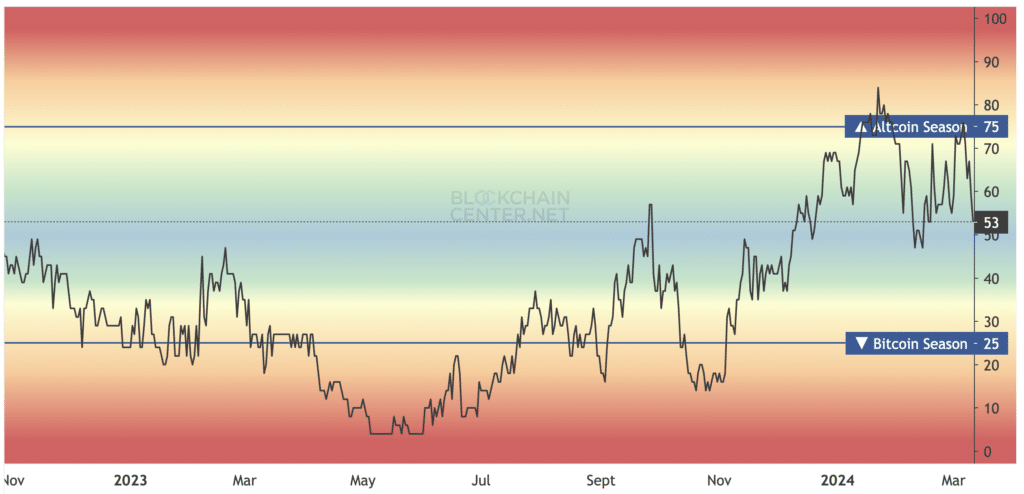

The phenomenon often called “altseason” sometimes follows a interval of serious development in Bitcoin’s worth. Throughout this section, buyers usually shift their beneficial properties from BTC into numerous altcoins, aiming to maximise returns. One key indicator of an altseason is the altseason index, which presents an easy method to gauge the market’s standing.

A worth of 53 within the index doesn’t imply that 53% of funding capital is allotted to altcoins; it signifies that 53% of altcoins have outperformed BTC previously 90 days. An index worth of 75% or increased alerts the onset of an altseason. In distinction, a drop under 25% suggests a “Bitcoin season,” the place investments pivot again to Bitcoin, reflecting its market dominance and affect.

How does Bitcoin affect altcoin costs?

Since its inception in 2009, Bitcoin has maintained its standing because the premier digital forex. Whereas a number of early forks emerged, none matched Bitcoin’s recognition till Ethereum’s (ETH) debut in 2015. Bitcoin’s pioneering function and its notion as a reliable retailer of worth catapulted its recognition, driving its worth from negligible to over $70,000.

Bitcoin’s rise to prominence paved the best way for cryptocurrencies to enter the mainstream. Its simple idea not solely boosted its personal worth but in addition impacted the broader crypto market. These days, most crypto buyers maintain some Bitcoin of their portfolios, underscoring its widespread affect. The better Bitcoin’s demand, the extra vital its affect in the marketplace dynamics of different cryptocurrencies.

BTC dominance

A key issue within the present market dynamics is that many altcoins, particularly these with vital capitalization, are traded in pairs with Bitcoin. Furthermore, most cash aren’t immediately purchasable with fiat forex, which means merchants usually want to amass BTC first.

In consequence, if an altcoin holder decides to depart the crypto market, they sometimes convert their property into Bitcoin earlier than exchanging it for normal forex. This course of tightly binds the worth of many altcoins to Bitcoin as a consequence of these frequent transactions.

Nonetheless, there are at all times exceptions. As an illustration, optimistic developments like an altcoin being listed on a serious alternate or asserting an improve can drive its value up, even in opposition to the general market pattern. Such surges are sometimes fueled by buyers swapping their BTC for the altcoin in anticipation of a value enhance.

The Bitcoin Dominance Index is helpful for assessing the well being of the altcoin market. This index signifies Bitcoin’s proportion of the full market capitalization. A lower in Bitcoin’s dominance normally means a relative enhance within the funding in altcoins. During times of fast crypto market development, a big drop on this dominance index is usually noticed.

Reserve property

Bitcoin, usually known as “digital gold,” is seen as a secure and reliable asset on this planet of cryptocurrency. Buyers generally evaluate different cryptocurrencies in opposition to Bitcoin’s efficiency. When Bitcoin’s worth goes up, it could possibly spark curiosity in numerous different cryptocurrencies.

Bitcoin’s function within the crypto market is more and more just like how the U.S. greenback features in world inventory markets—it’s like a reserve forex. As a consequence of regulatory guidelines in some international locations, sure cryptocurrency exchanges don’t enable direct trades of cryptocurrencies for normal cash (fiat). In such instances, buyers normally purchase Bitcoin first after which use it to buy different cryptocurrencies. Stablecoins, that are designed to keep up a secure worth, serve an identical objective. As an illustration, listed here are the newest reserves of the Binance crypto alternate:

Cryptocurrency values are generally measured in opposition to the U.S. greenback, however it’s additionally common to check them with Bitcoin, because it’s a key part in main market pairs. This explains why the general market usually follows Bitcoin’s traits, whether or not rising or falling.

Predicting the altcoin market’s future

Regardless of altcoins traditionally following Bitcoin’s lead, future traits would possibly differ considerably. Listed here are some eventualities and elements that might change this dynamic:

- Technological improvement and innovation: Many altcoins goal to deal with particular challenges or supply options not present in Bitcoin. If these improvements change into foundational for real-world functions, altcoins’ reliance on Bitcoin may lower.

- Mass adoption: If altcoins achieve extra acceptance amongst companies, governments, or massive organizations, their hyperlink to Bitcoin may weaken.

- Market variety and specialization: Because the crypto market matures, altcoins would possibly concentrate on particular niches, making them much less influenced by basic market actions and Bitcoin fluctuations.

Whereas Bitcoin nonetheless holds a central place, the long run extent of altcoins’ dependence on it’s an open query, topic to a variety of technological, adoption, and market elements.