ONI, the utility token of Anonify, has skilled a dramatic decline, dropping over 90% prior to now few weeks, contrasting sharply with the cryptocurrency markets, which have seen a notable enhance in costs lately, with Bitcoin reaching new highs.

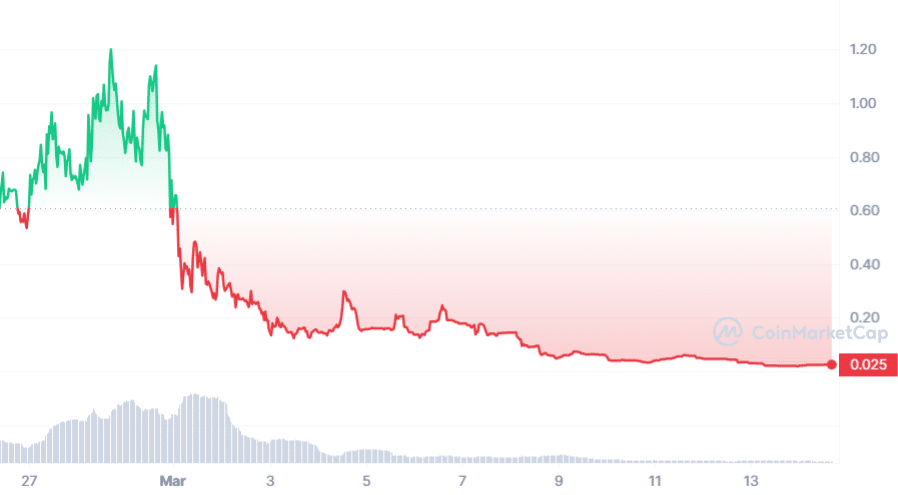

The token, which noticed a surge in demand following its launch on Feb. 20, achieved an all-time excessive of $1.18 on Feb. 28, solely to fall to $0.01974 by March 13. This sharp decline has sparked discussions relating to the opportunity of the challenge being a possible rug pull.

Anonify, a privacy-centric Telegram bot, claims to facilitate safe cross-chain swaps throughout varied blockchains. It emphasizes full anonymity, eliminating the necessity for private data and making certain the confidentiality of customers’ identities. The platform’s cross-chain swap functionality has been marketed as a key function, permitting for simple token and coin exchanges between totally different blockchains.

Anonify’s Blast Bridge, as described by the challenge, goals to reinforce the person expertise by enabling smoother interactions between Ethereum (ETH) and the Blast Layer 2 (L2) community, in line with the challenge’s claims. With the launch of Blast’s mainnet on Feb. 26, Anonify announced its bridging capabilities between BLAST and ETH.

The challenge claims this enables customers to bridge property between the 2 networks with out the standard 14-day ready interval required by official Blast bridges. This announcement was a part of the challenge’s broader claims of facilitating a major enhance in liquidity influx into the Blast Ecosystem over the past 5 days, intending to enhance transaction effectivity and safety throughout the ecosystem.

Nevertheless, on March 1, the Anonify crew addressed a problem the place some customers prematurely accessed the Blast L2 mainnet utilizing an Ethereum contract handle, bypassing the official bridge. The crew emphasised their dedication to platform safety and integrity, selecting to delay the activation of their bridge to mitigate potential dangers. This stance was strengthened by their clarification relating to token transfers, countering hypothesis about promoting actions on the chart.

By March 8, Anonify announced the approaching shutdown of the Blast -> ETH bridge, citing an absence of great demand. Regardless of this, the crew revealed plans to repurpose the UI for a forthcoming net app designed to supply a extra seamless swapping expertise, aligning with their roadmap.

In a dialog with crypto.information, an investor in ONI generally known as “Grinding Poet” on X shared their perspective on the unsettling developments inside the Anonify challenge.

“I imply, no real updates from devs, they appear to be simply tax farming as there’s a 4% purchase/promote tax,” Grinding Poet expressed, indicating a deep-seated concern over the builders’ intentions.

“I purchased it coz they promised a quick both-way bridge for Blast, with a privateness narrative, I hoped it could be the 0x0 second for Blast. It’s not regular for tasks to dump 98%+ at launch of the chain they’re presupposed to be a mascot of,” Poet added.

Additional elaborating on the developments, Grinding Poet posited that the builders “farmed everybody,” a sentiment exacerbated by the latest announcement of the bridge’s suspension. In line with the investor, this motion has considerably depressed the value, including that “absolutely insiders bought” whereas “most outsiders are nonetheless holding” onto their property. Grinding Poet, holding a “sizable funding” in ONI, voiced these considerations amid a burgeoning sense of frustration inside the ONI investor group.

“In the event you ask me, Snup has a plan. He might depart however didn’t and glued web sites downside. He stopped speaking with us and being extra centered on different issues. I imply he was checking the chat and so forth! Give him a while he’ll announce and replace the challenge. At this level we can not do something! Simply ready for him. Dont put stress on him at this level. hes a human too… you’re feeling me?,” wrote Mo, an investor within the Anonify telegram group.

In the meantime, one other Investor, going by Mr Castiel, additionally echoed related sentiments, including:

“Okay, it’s fairly bizarre all went darkish for few days, however it has working product up and operating [..] At present, mc [market cap] is 100k. I Imply. 100k it’s not even a fantastic threat at this level. Individuals listed here are speaking: ‘when it hits 1 million, I’ll purchase again in???’ That’s lacking a 10x. Afaik 100k is backside. All-time low. Alternative of a lifetime or break even. “

Crypto.information additionally performed an examination of the challenge’s Telegram group, witnessing additional complaints from some customers. Whereas criticisms highlighted considerations over challenge administration and the absence of promoting efforts for a challenge with an operational product, others confirmed assist for the challenge’s nameless creator, “Snup,” viewing the present market cap as a possible funding alternative.

Crypto.information reached out to Snup devs, however has but to listen to again.

On the time of writing, the token was priced simply $0.02474, down 97.9% from its all-time excessive worth.