Bitcoin’s retrace beneath $63,000 has provided a clearer view of assist and resistance ranges to observe resulting in subsequent month’s halving.

Bitcoin (BTC) and cryptocurrency analyst Ali-Charts recognized three essential costs that function assist ranges for the most important digital asset on the earth. Based on the on-chain observer citing Glassnode knowledge, $61,100, $56,685, and $51,530 ought to cushion in opposition to additional Bitcoin dips.

Conversely, $66,990 and $72,88 have emerged as the next resistance ranges to interrupt after BTC set a brand new all-time excessive on March 14, per CoinGecko. The crypto peaked at $73,737 following a number of weeks of huge inflows into U.S. spot Bitcoin ETF merchandise.

Bitcoin down 6%, spot BTC ETFs log unfavorable day by day flows

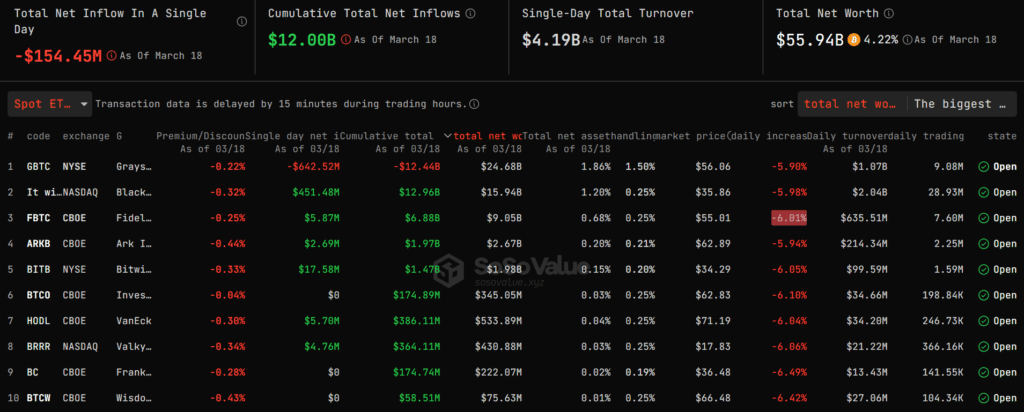

BTC’s 6% downturn on March 19 adopted the primary single-day internet outflow since late final month. Though BlackRock’s BTC ETF drew in $451 million, traders ditched $642 million price of Grayscale’s GBTC, per Soso Worth. March 18 marked the most important GBTC departure up to now, ETF knowledgeable Eric Balchunas confirmed.

Value motion resulted in internet outflows of $154 million as eight different issuers attracted lower than $20 million every on the day. Franklin Templeton, Invesco Galaxy, and WisdomTree funds noticed $0 single-day internet inflows.

Whereas the numbers deviated from consecutive inflows beforehand recorded, spot BTC ETFs have nonetheless collected 4.2% of Bitcoin’s obtainable provide in three months of buying and selling. 9 funds boast over $20 billion in property underneath administration, led by BlackRock’s greater than 203,000 BTC valued at practically $16 billion.

Veterans like Balchunas additionally predict an enlargement in spot BTC ETF demand as extra institutional gamers allocate capital and assist publicity to the asset class. Wall Avenue asset managers like Financial institution of America’s Merrill Lynch and Wells Fargo have added spot Bitcoin ETFs to choices, backtracking an earlier decision to disallow such funds for shoppers.