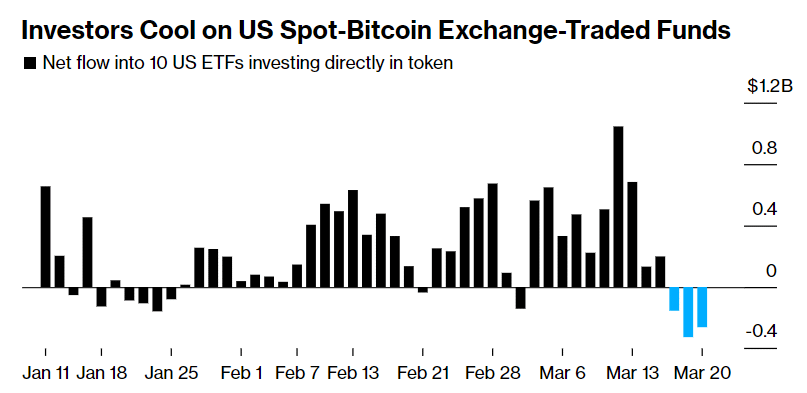

Spot Bitcoin ETFs skilled their largest three-day withdrawal since their launch in January.

The development marked a major shift from the excessive demand propelling Bitcoin to its all-time excessive. Between Monday and Wednesday, these ETFs noticed a withdrawal of $742 million, indicating substantial outflows from the Grayscale Bitcoin Belief alongside a lower in new investments in competing funds by important companies equivalent to BlackRock and Constancy Investments.

Regardless of this, based on Bloomberg knowledge, the ETFs have attracted $11.4 billion in web investments since inception, making them among the many most profitable ETF launches. The Grayscale Bitcoin Belief, now an ETF, reported $13.3 billion in outflows.

Whereas world shares and gold continued to rise, Bitcoin’s rally cooled because the market digested the ETF outflow knowledge. Nevertheless, Bitcoin’s worth surged over 5% at this time, fueled by the Federal Reserve’s indications of potential rate of interest cuts, which lifted varied asset courses.

The inventory value of Bitcoin-related firms has additionally seen notable beneficial properties at this time after a week-long decline. MicroStrategy, the most important holder of BTC, noticed its share value improve by 15% at this time. Shares from main BTC mining firms like Marathon Digital and Riot Platforms additionally recovered barely at this time following Bitcoin’s restoration.