Researchers at CoinGecko say 42% of loans from non-public credit score protocols give attention to rising markets, significantly within the automotive sector.

Non-public credit score protocols — like Centrifuge and Goldfinch — allocate over 42% of their excellent loans to a automotive financing, CoinGecko has revealed in a recent research report, including that the sum is totaling greater than $196 million in lively loans. The surge in auto loans, which reached over $168 million throughout 60 loans previously 12 months, is primarily pushed by debtors primarily positioned in rising markets like Africa, Southeast Asia, Central America, and South America.

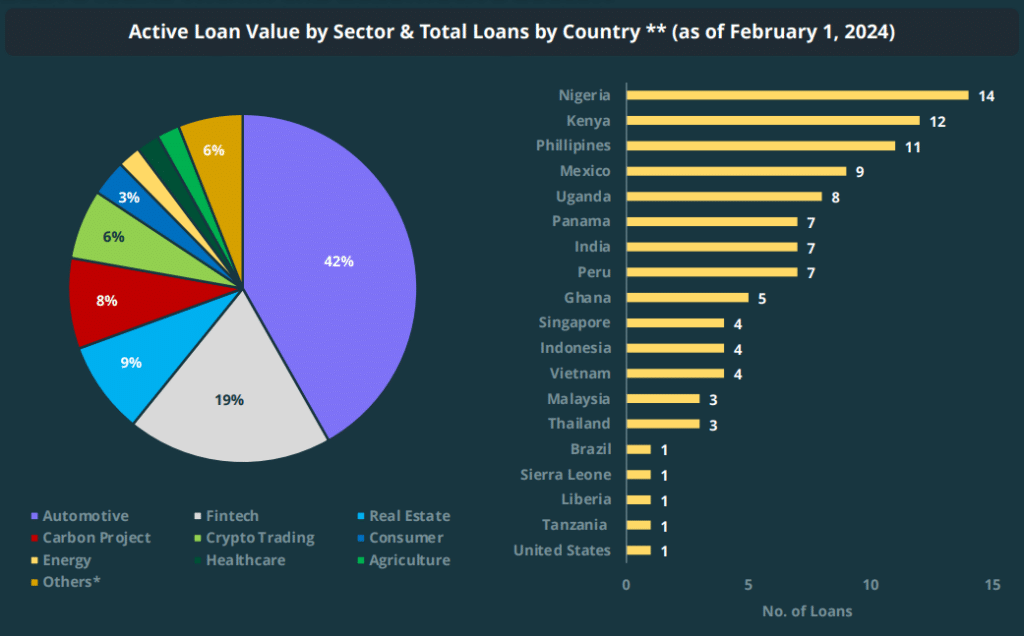

Based on CoinGecko, the expansion within the automotive mortgage sector has surpassed that of fintech and actual property money owed, which now solely comprise 19% and 9%, respectively. Analysts famous that out of 840 loans prolonged to the true property and crypto buying and selling sectors, solely 10% stay lively, with most both repaid or defaulted.

“The crypto buying and selling sector alone noticed 13 mortgage defaults within the wake of the Terra/Three Arrows Capital collapse.” CoinGecko

Information compiled by CoinGecko signifies that Nigeria leads in lively loans by worth, with 14 lively loans as of Feb. 1, adopted by Kenya with 12 lively loans and the Philippines with 11 lively loans. In whole, over 40 loans originate from Africa, constituting 40.8% of the 103 accounted loans. These loans primarily goal small and medium-sized enterprises, carbon tasks, automotive tasks, fintech, and shopper loans.