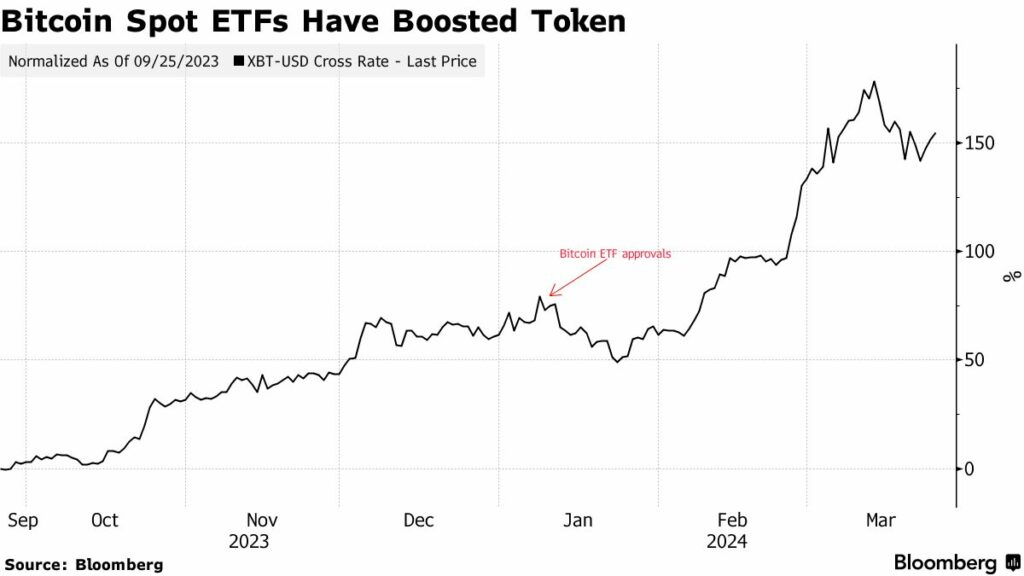

Goldman Sachs sees a surge in institutional shoppers gaining curiosity in crypto because of the Bitcoin ETF.

In accordance with Max Minton, Goldman’s Asia Pacific head of digital property, the approval of Bitcoin ETFs has considerably influenced this pattern.

“The latest ETF approval has triggered a resurgence of curiosity and actions from our shoppers. A lot of our largest shoppers are lively or exploring getting lively within the area,” Minton mentioned in a launch.

Goldman Sachs, which launched its cryptocurrency buying and selling desk in 2021, gives its shoppers numerous crypto-related providers. These embody cash-settled Bitcoin (BTC) and Ether (ETH) possibility buying and selling and futures buying and selling for these cryptocurrencies on the Chicago Mercantile Alternate. Nevertheless, the agency doesn’t immediately commerce the precise crypto tokens.

“It was a quieter 12 months final 12 months, however we’ve seen a pickup in curiosity from shoppers in onboarding, pipeline, and quantity because the begin of the 12 months,” Minton mentioned, contemplating the market traits.

The renewed curiosity primarily stems from Goldman’s conventional consumer base, which is predominantly hedge funds. Nonetheless, the financial institution is broadening its horizon to accommodate a various clientele, together with asset managers, financial institution shoppers, and a choose group of digital asset corporations.

Goldman’s shoppers make the most of crypto derivatives multifacetedly, encompassing directional bets, yield enhancement, and hedging methods. Whereas Bitcoin-related merchandise stay the first focus, the potential approval of Ether ETFs in the US might shift the curiosity towards Ether-related merchandise.

Past buying and selling, Goldman Sachs is pioneering digital asset area by tokenizing conventional property utilizing blockchain expertise. The financial institution has developed a digital asset platform, GS DAP, and has carried out pilot assessments on a blockchain community to facilitate connectivity amongst banks, asset managers, and exchanges.

Goldman can be investing in startups aligning with its strategic imaginative and prescient for the digital asset market, notably in blockchain infrastructure corporations.

“We now have a portfolio and can make investments if or when it makes strategic sense,” Minton mentioned.