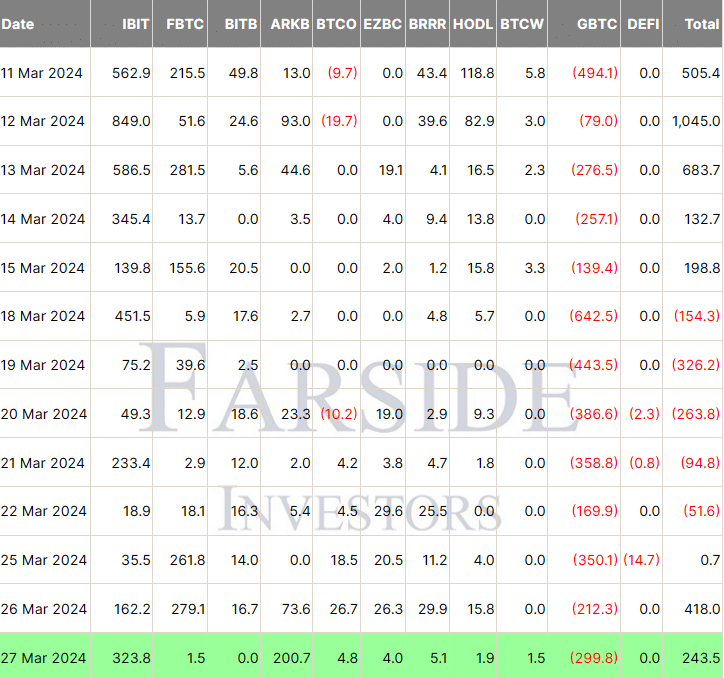

On March 28, The ARK 21Shares Bitcoin ETF witnessed an unprecedented $243.5 million in investments, marking a major uptick over 5 instances its normal each day consumption, as Bitcoin neared the $72,000 threshold.

In keeping with early insights from Farside Traders, the influx on March 27 into the ARK 21Shares Bitcoin ETF surged to 4 instances its common each day influx of $43.9 million since its debut on January 11.

This inflow virtually tripled yesterday’s $73.6 million, considerably outpacing the shortage of influx state of affairs on March 25.

In the meantime, Blackrock’s Bitcoin ETF (IBIT) noticed an much more spectacular influx, with $323.8 million in new investments.

In distinction, different Bitcoin ETFs like Valkyrie Bitcoin ETF (BRRR) recorded $5.1 million, Invesco Galaxy Bitcoin ETF (BTCO) noticed $4.8 million, Franklin Bitcoin ETF (EZBC) attracted $4 million, and VanEck Bitcoin ETF (HODL) noticed $1.9 million in new investments.

Each WisdomTree Bitcoin ETF (BTCW) and Constancy Investments Bitcoin ETF (FBTC) reported inflows of $1.5 million, showcasing extra modest beneficial properties.

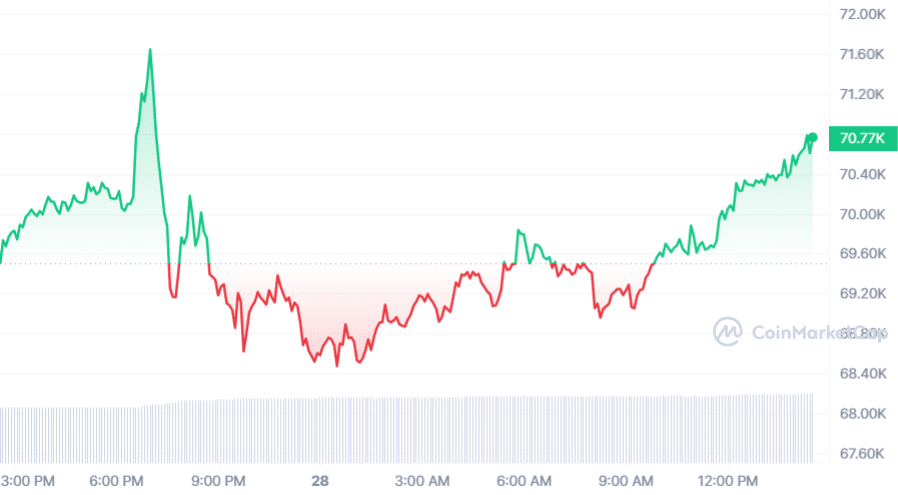

As this occurred, Bitcoin reached a excessive of $71,670 however dipped under the $69,000 stage, ultimately settling at $69,698 by day’s finish. At the moment, Bitcoin is priced at $70,783, in accordance with CoinMarketCap.

Cryptocurrency analysts have began debating that the deal with Bitcoin’s quick value actions overshadows a extra important development.

On March 28, by way of a post on X, crypto analyst Gumshoe shared together with his 28,900 followers that the eye is overly focused on each day value actions quite than acknowledging the substantial investments flowing into Bitcoin.

“With Bitcoin ETFs experiencing document inflows, the priority over the each day value appears misplaced,” he commented.

On March 27, Bitwise’s Chief Funding Officer Matt Hougan identified on X that {many professional} buyers are nonetheless barred from buying Bitcoin ETFs, notably within the UK the place the regulatory setting stays cautious in the direction of crypto.

He instructed that the panorama for Bitcoin ETF investments would evolve steadily over the subsequent couple of years by way of quite a few particular person assessments.

As these important inflows into Bitcoin ETFs mirror a rising institutional curiosity in cryptocurrency, ARK Invest’s CEO, Cathie Wooden, has projected Bitcoin’s value might attain as high as $3.8 million, pushed by its rising function within the “monetary superhighway.”

Wooden contends that the SEC’s cautious strategy to institutional Bitcoin investments might inadvertently increase its value.

The launch of those monetary merchandise has led to a spike in demand, breaking earlier US ETF funding data and stirring renewed curiosity in Bitcoin, which these funds immediately procure and handle.

Trade consultants support Wood’s view that the forthcoming Bitcoin halving occasion in April will result in a provide shock, bolstering the continued demand-driven value rally.