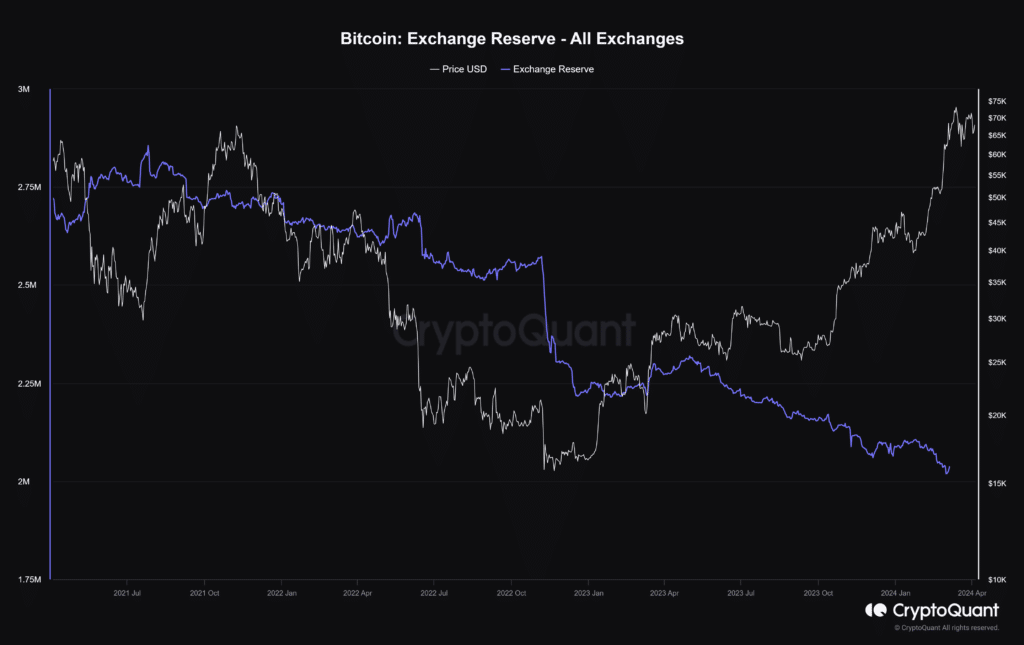

Bitcoin alternate reserves have plummeted to its lowest ranges since early 2021, indicating that holders may retailer BTC one other manner.

Greater than 90,700 bitcoin have been withdrawn from main cryptocurrency exchanges over the previous month, reveals CryptoQuant, stressing a discount in Bitcoin’s liquid provide and hinting at a long-term holding technique amongst traders.

In line with information from CryptoQuant, the noteworthy outflow from exchanges to chilly storage aligns with a multi-year pattern, seemingly pushed by the digital asset’s value enhance, the approval of spot Bitcoin ETFs, and anticipation of the halving occasion.

In July 2021, Bitcoin alternate reserves hovered across the 2.8 million mark, CryptoQuant information exhibits, with a decline of roughly 900,000 cash because the agency started monitoring this metric.

Regardless of the tightening of provide, Glassnode’s current report signifies a notable shift from long-term to short-term holders.

“Following a historic tightness in provide, the divergence between lengthy and short-term holder provide has began closing,” Glassnode notes, suggesting that rising costs and growing unrealized income are prompting long-term holders to liquidate their belongings.

The report additional states that the short-term holder provide has surged by round 1.12 million bitcoins, absorbing the distribution strain from long-term holders.

On the macroeconomic entrance, Bitcoin’s (BTC) value has seen a modest uptick of roughly 3.2% prior to now 24 hours, buying and selling at $68,265 as of 1:46 p.m. ET. Nonetheless, it nonetheless trails about 10% behind its all-time excessive of $73,000 from mid-March.

Kurt Wuckert Jr., the Chief Bitcoin Historian at CoinGeek, likens Bitcoin to gold and money, noting its resistance to regulator suppression.

Ordinals Pockets CEO Joshua Petty stays optimistic about Bitcoin’s future, suggesting it may evolve or function a base for digital money even underneath regulatory challenges.