Lengthy-term Bitcoin (BTC) holders have began promoting their holdings to a wave of recent buyers, sparking a recent surge within the cryptocurrency’s value and realized capitalization.

Per an April 2 analysis report from Glassnode, Bitcoin’s current rise in value discovery above new all-time highs has tempted holders who had been already excessive into income to distribute to a recent investor cohort.

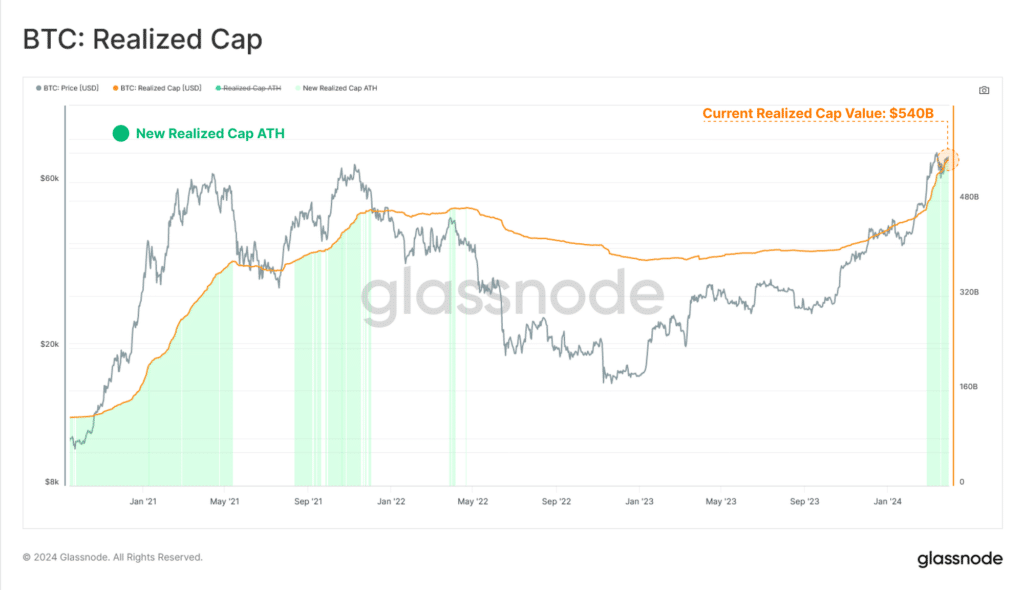

Glassnode employs the Realized Cap metric, which logs the transaction value for every Bitcoin to find out the proportion of holders making a revenue or a loss. The metric has reached an all-time excessive (ATH), indicating a big market milestone, in line with Glassnode.

“This leads to spent cash usually being revalued from a decrease cost-basis, to a better one. As these cash change fingers, we will additionally contemplate this to be an injection of recent demand and liquidity into the asset class.”

This mechanism is neatly depicted by the Realized Cap statistic, which tracks the whole USD liquidity ‘saved’ within the asset or class. The Realized Cap has reached a brand new ATH worth of $540 billion and is rising at an unprecedented fee of greater than $79 billion every month.

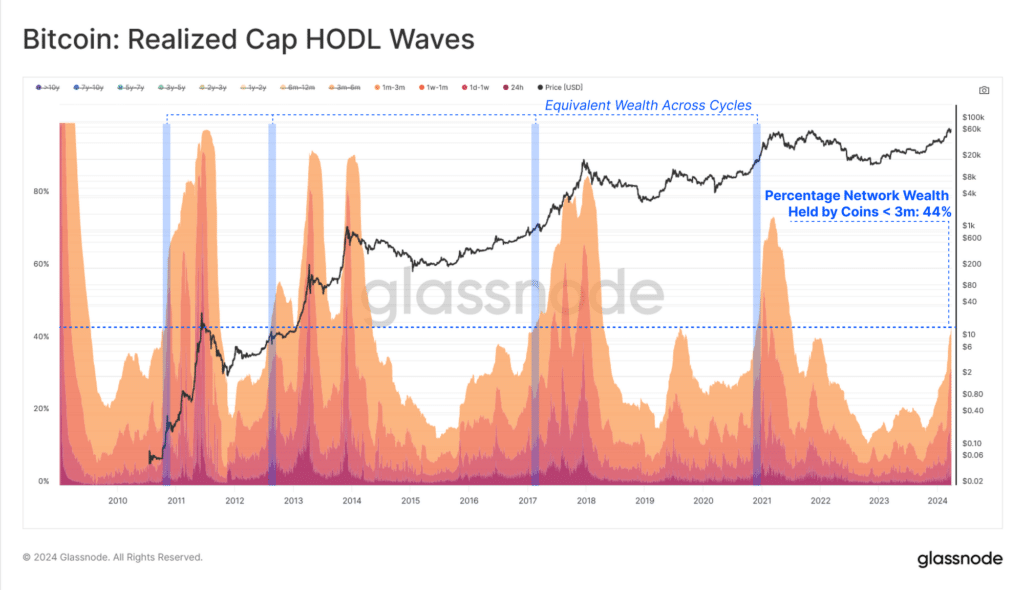

In accordance with Glassnode, 44% of all BTC in circulation are actually held by newer addresses which have been lively for lower than three months. In accordance with the agency’s statistics, rising above the 44% threshold is usually related to mid-stage bull markets.

“If we segregate for coin-ages youthful than 3 months, we will see a pointy improve over current months, with these newer buyers now proudly owning ~44% of the mixture community wealth.”

It decided that there was a “distinct shift in investor behavioral patterns.”

“Lengthy-Time period Holders are effectively into their distribution cycle, realizing income, and re-awakening dormant provide to fulfill new demand at larger costs.”

According to Glassnode researcher Checkmatey,’ the realized cap is growing as outdated cash are revalued larger, with GBTC accounting for about 30% and HODLers promoting the rest.

Nevertheless, the evaluation was performed when Bitcoin approached an all-time excessive for the second time, and markets started to fall earlier this week. BTC reached a excessive of $73,734 on March 14, fell by about 17%, and recovered to $71,550 on March 28 earlier than resistance proved too highly effective.

It fell barely beneath $65,000 through the Wednesday morning Asian buying and selling session, reaching $64,573 earlier than rising to $66,111 on the time of writing, per CoinMarketCap. Bitcoin is at the moment down 10% from its all-time excessive value.

The general market capitalization is down 1% on the day to $2.5 trillion, or roughly 20% decrease than its all-time peak set in November 2021.

Except for a couple of hyped meme cash, altcoins haven’t moved a lot on this market cycle.

At present, most of them are all down, with XRP down 2.3% to $0.576 and Dogecoin down 2.7% to $0.180.