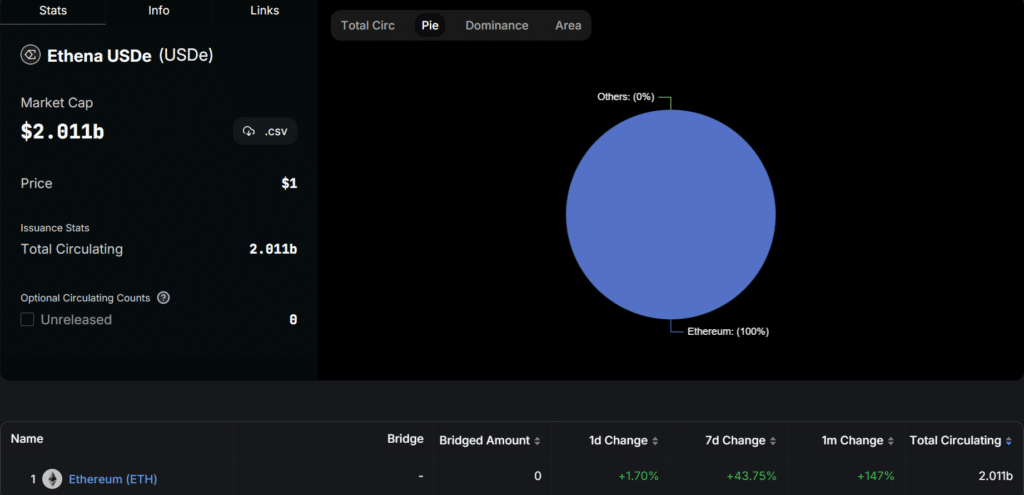

Ethena Labs’ artificial greenback has surged to a $2 billion market cap lower than two months after the protocol launched its product on Ethereum’s public mainnet.

Launched in February, the market cap of stablecoin USDe has grown over 147% within the final 30 days, per DefiLlama. CoinGecko categorizes the cryptocurrency because the fifth largest token within the stablecoin market.

USDe is a yield-bearing crypto that deviates from the standard stablecoin mannequin, holding money reserves and money equivalents to take care of pegs to fiat currencies just like the U.S. greenback. As a substitute, USDe faucets spinoff hedging in opposition to collateral positions denominated in Bitcoin (BTC), Ethereum (ETH), ETH liquid staking tokens, and Tether (USDT).

At a $2 billion provide and market cap, Ethena’s artificial greenback is forward of incumbents. Solely USDT, Circle’s USD Coin (USDC), DAI, and First Digital USD (FDUSD) at present eclipse USDe amongst stablecoin choices.

Specialists draw parallels between Ethena’s stablecoin, Luna UST

USDe might have loved a meteoritic rise in lower than 1 / 4. Nonetheless, trade veterans are involved that Ethena’s product options a number of similarities to UST, Terra’s algorithmic stablecoin, which finally triggered a $60 billion collapse in Might 2022.

Blockchain developer and main Fantom (FTM) contributor Andre Cronje published a long-form tweet on X assessing whether or not USDe is likely to be the following UST. CryptoQuant Founder and CEO Ki Younger Ju additionally questioned if Ethena’s onboarding on BTC as a backing asset might set off the same contagion.