What does the longer term maintain for the platform now that Bankman-Fried faces a long time in jail, and is there any probability for a revival of the FTX trade?

As soon as a number one title within the crypto world, FTX confronted a dramatic downfall in November 2022, resulting in its chapter. Lately, Sam Bankman-Fried, FTX’s former CEO, obtained a 25-year jail sentence for numerous crimes, together with fraud and stealing consumer funds. This raises an enormous query: What occurs subsequent for FTX? Crypto.information is exploring how this verdict will affect the way forward for the trade.

Prosecutor requested 40-year sentence

Based on the choose, FTX shoppers misplaced $8 billion and buyers one other $1.7 billion, with a further $1.3 billion from the trade’s collectors. This monetary turmoil led to no less than three FTX shoppers taking their very own lives. Within the courtroom, the opportunity of a life sentence for Sam Bankman-Fried was on the desk. Decide Lewis Kaplan stated the previous CEO of FTX dedicated false testimony on no less than three events.

Bankman-Fried admitted to money owed owed by Alameda Research, a fund tied to FTX that additionally went bankrupt. He claimed, nevertheless, that FTX may have averted chapter and sorted out its points. Alameda had entry to FTX shoppers’ funds and used them for dangerous investments and different spending, together with donations to American politicians.

Whereas prosecutors pushed for a 40-year sentence, Bankman-Fried’s attorneys argued for a a lot shorter sentence of six and a half years at most. The protection requested to think about his background, schooling, Wall Avenue expertise, and position in founding buying and selling corporations, arguing that greed wasn’t his sole motivation.

Failed makes an attempt to restart FTX

On June 28, 2023, FTX CEO John Ray stated the corporate had launched a stakeholder engagement course of to reboot the FTX.com trade. As The Wall Street Journal’s sources famous, the trade would probably rebrand when it restarts.

In August 2023, FTX unveiled a relaunch plan that included, amongst different issues, the creation of a brand new worldwide market for purchasers outdoors the USA. On the finish of October 2023, FTX managers were negotiating the restoration of the platform with three buyers. The trade thought-about promoting the corporate and buyer base or bringing in a associate to assist it reopen.

Based on Kevin M. Cofsky, an funding banker at Perella Weinberg Companions, who oversaw the negotiation course of, the trade ought to decide whether or not to continue operations by mid-December 2023. FTX is contemplating two transaction choices: promoting the complete trade and buyer base or bringing in a associate to assist it reopen.

“We’re partaking with a number of events day by day.”

Kevin M. Cofsky, an funding banker at Perella Weinberg Companions

Nonetheless, on the finish of January, FTX deserted makes an attempt to renew operations, deciding to liquidate all property and return funds to clients.

For over a 12 months, FTX’s new administration has been dealing with its chapter and attempting to get well what’s left of the corporate’s property. FTX legal professional Andy Dietderich shared that they’ve been in talks with potential consumers and buyers for months. Nonetheless, these events want extra time earlier than they will commit the numerous funds wanted to revive the trade.

“FTX was an irresponsible sham created by a shameful felon. The prices and dangers of making a viable trade from what Mr. Bankman-Fried left in a dumpster had been just too excessive.”

Andy Dietderich, FTX legal professional

He expressed his staff’s disappointment with FTX 2.0, as the corporate nonetheless holds invaluable buyer information that may very well be used to generate income.

The legal professional additionally identified that FTX’s earlier acquisitions, price lots of of thousands and thousands of {dollars}, turned out to be largely unsuccessful. Curiosity in shopping for these property is restricted. Even LedgerX—one of many few trade divisions thought-about solvent when the mum or dad group filed for chapter—was a horrible funding, Dietderich emphasised.

What’s going on round FTX?

The interim administration of the bankrupt FTX Group is promoting crypto property and hoarding money to repay money owed to shoppers whose accounts had been frozen after the platform collapsed within the fall of 2022.

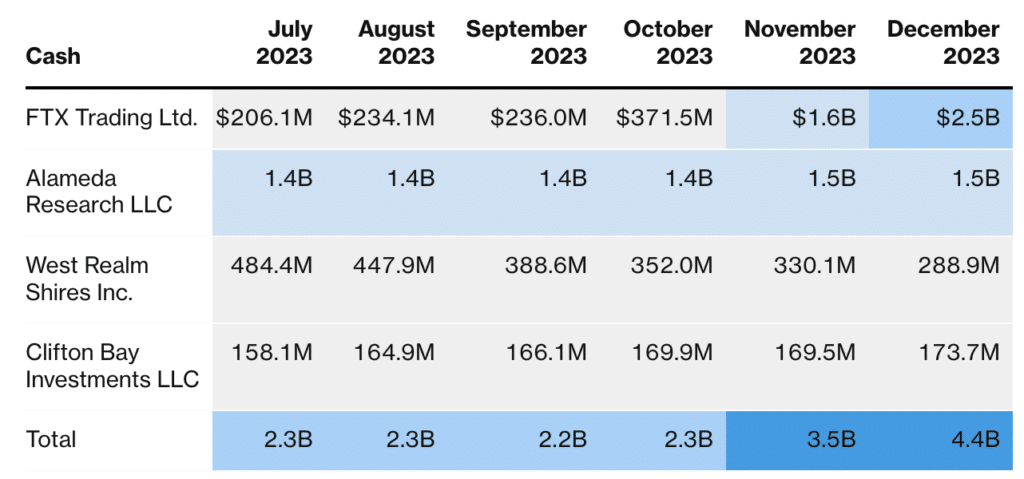

Bloomberg sources report that FTX Group’s 4 most important subsidiaries, together with FTX Buying and selling and Alameda Analysis, doubled their money property to $4.4 billion in 2023. In feedback despatched by FTX chapter consultants to U.S. regulators, it’s stated that in December final 12 months alone, the interim administration of FTX gained greater than $1.8 billion from the sale of digital property.

FTX has recovered over $7 billion in property to return cash to clients and has agreed with numerous authorities regulators, Dietderich stated. The regulators determined to attend till clients had been totally compensated earlier than trying to get well about $9 billion in claims.

Now FTX expects to pay all clients in complete however will calculate their funds primarily based on cryptocurrency costs on the trade price in November 2022, when the collapse of the trade led to the collapse of the complete crypto market. Dozens of FTX shoppers challenged this choice in court docket. Paying compensation at this price (at a Bitcoin worth of about $17,000) would imply that they fully missed out on the expansion of the crypto market in 2023 as a result of their property had been blocked when the trade went bankrupt.

Nonetheless, the court docket rejected their appeals and, at a listening to on Jan. 31, approved awards at 2022 costs, saying U.S. chapter regulation is clear that money owed have to be discharged primarily based on their worth on the date the corporate filed for chapter.

Will SBF conviction be a turning level in FTX story?

FTX and Sam Bankman-Fried had been as soon as carefully linked, however for the reason that trade declared chapter, their paths have diverged. Bankman-Fried now faces jail time, whereas FTX is left as a shadow of its former self, specializing in paying again its shoppers.

This separation means Bankman-Fried’s destiny most likely gained’t affect FTX’s present operations. With out discovering anybody to revive the trade, FTX’s future seems to be centered on settling its money owed. As for Bankman-Fried, he’s prone to spend a few years in jail, marked because the mastermind behind one of many largest frauds within the crypto world.