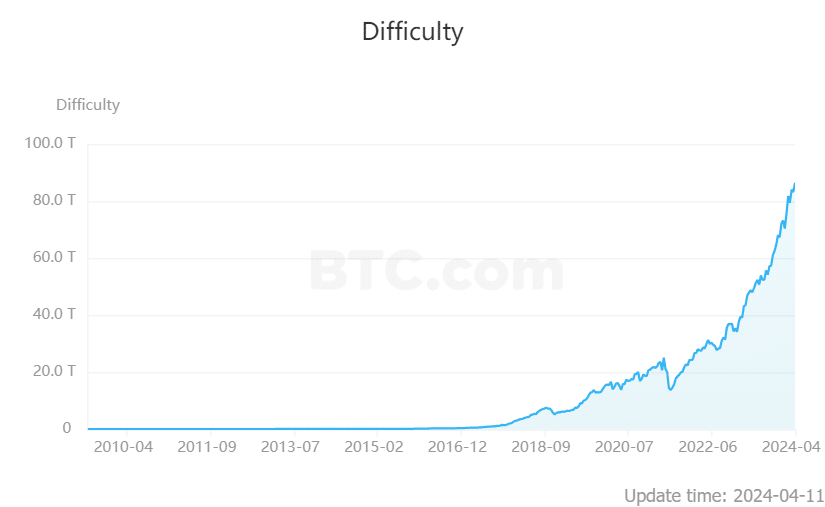

Bitcoin’s mining problem achieved a file excessive of 86.4 trillion amid upcoming halving in April.

Information gathered by btc.com confirmed that Bitcoin’s (BTC) mining problem achieved a file excessive of 86.4 trillion as corporations generated huge quantities of computing capability earlier than the much-anticipated halving occasion later this month.

Mining problem refers back to the computer-generated energy wanted to resolve advanced mathematical equations required for unlocking new Bitcoins. BTC is scheduled to endure a code change by April 20, and the newest mining problem report is the ultimate replace earlier than this halving.

Based on btc.com, mining problem has elevated by some 600% since 2020, when the final halving occurred. Additionally, it has been in a steady uptrend since Might 2021.

BTC miners are churning extra computing power than ever as these entities look to stockpile the crypto and bolster money reserves earlier than block rewards are halved. For miners, block rewards are the principle earnings supply, and shortly, the reward will likely be decreased to three.15 BTC. The drop will even tighten day by day Bitcoin issuance from 900 to 450.

Bitcoin halving may set off short-term market decline

Traditionally, the asset declines between 15% to 40% pre-halving, per CoinMarketCap, and enters a parabolic enhance in the long term following the code change. Nonetheless, Bakhrom Saydulloev, Mercuryo product lead, instructed crypto.information {that a} short-mid time period retrace triggered by miners liquidating BTC could occur.

Historic information exhibits that within the quick aftermath of the halving, Bitcoin costs sometimes expertise a lower. On the identical time, within the medium to long run, they have a tendency to set off bull runs. As an example, after a halving, some miners could really feel pressured to promote their Bitcoin holdings to cowl operational prices because of the 50% discount in block rewards, affecting their profitability. This might result in a market “sell-off” as some traders develop into unsure about future worth traits.

Bakhrom Saydulloev, Mercuryo product lead

Saydulloev additional opined that earlier halving occurred throughout higher financial and funding climates, citing the present unsure trajectory round crypto rules. Conversely, basic sentiment posits that the presence of spot Bitcoin ETFs may incentivize money circulate into the cryptocurrency. Spot Bitcoin ETFs have already garnered over $200 billion in buying and selling quantity in lower than 4 months.