The Grayscale Bitcoin Belief (GBTC), an exchange-traded fund, has skilled a big drop in outflows, reaching a file low that was almost 90% decrease than the day past.

The most recent shift occurred concurrently with Bitcoin’s worth rebound after the most recent United States inflation information was launched, which launched volatility into the market.

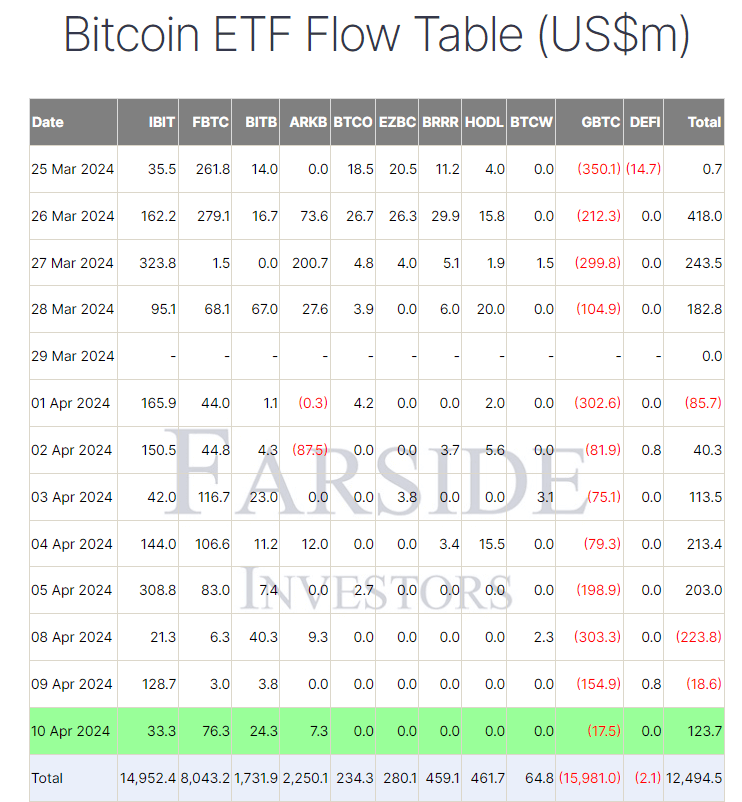

On April 10, GBTC skilled outflows amounting to $17.5 million, a stark distinction to the $154.9 million recorded on April 9, based mostly on information from Farside.

The worth of Bitcoin has seen a 2.08% improve over the past 24 hours, now valued at $70,542, according to CoinMarketCap. This rise adopted a dip to native lows of $67,482 after the March U.S. Shopper Value Index (CPI) report indicated a higher-than-anticipated 3.5% year-on-year improve. This growth raised considerations that the U.S. Federal Reserve may postpone rate of interest cuts additional.

Crypto trade observers have expressed optimism that the slowdown in GBTC outflows, which have totaled $16 billion for the reason that fund transitioned to a spot Bitcoin ETF in January, could also be starting.

Thomas Fahrer, CEO of the crypto-focused opinions portal Apollo, queried his 41,500 X followers on April 11 if “GBTC promoting [is] over?” He famous that the outflows on April 10 have been about equal to 250 Bitcoin, almost a 95% drop from the start of the week.

On April 8, simply days prior, Grayscale noticed outflows of 4,288 Bitcoin, totaling $303 million.

The bottom earlier outflow was on Feb. 26, amounting to $22.4 million, with the typical day by day outflow over 4 months being $257.8 million.|

Amongst BTC ETFs, which embody BlackRock IBIT, Constancy FBTC, ARK’s ARKB, and Bitwise BITB, solely these registered constructive inflows on April 10, based on Farside information.

FBTC led with an influx of $76.3 million, its largest since April 5, bringing its whole inflows to $8,043.2 billion. The collective web inflows into Bitcoin ETFs now stand at $12,494.5 billion.

The upcoming Bitcoin halving, anticipated round April 20, is one other focus for the market. The occasion will halve the Bitcoin block issuance price from 6.25 cash per block to three.125.

Halvings, which happen each 4 years, have traditionally led to a surge in Bitcoin’s worth as a result of diminished provide progress.

With the present enthusiasm round spot Bitcoin ETFs, the market anticipates even higher demand, doubtlessly intensifying the rally.

In a Bloomberg interview on April 9, Fred Thiel, CEO of Bitcoin mining agency Marathon Digital, recommended that latest spot Bitcoin ETF approvals have introduced substantial capital into the market, thereby accelerating the market’s appreciation, which was usually anticipated after the halving of Bitcoin.

Bitcoin’s worth has seen a greater than 60% improve within the months resulting in the halving, with consultants indicating a continued bullish market pushed primarily by rising demand slightly than the halving’s provide lower.

“The previous halvings have introduced exceptional provide shock, however this 12 months’s occasion shall be totally different. It is because we’ve by no means had each a provide shock and a requirement shock on the identical time. And the catalyst is undoubtedly ETFs – single-day inflows into spot BTC ETFs have already topped $1 billion, “Andras Kristof, CEO and co-founder of Galaxis, informed Crypto.information.

He went on to counsel that if demand for the brand new ETFs is as nice as it’s now, it is going to simply add to the day by day shopping for strain. Towards the backdrop of decreasing provide, this might lead to a big spike in bitcoin worth and volatility.

“Whereas the value of Bitcoin has greater than doubled over the previous 12 months, there may be steam left within the rally. The halving impact will very doubtless pull institutional traders in from the sidelines as they succumb to the worry of lacking out.”