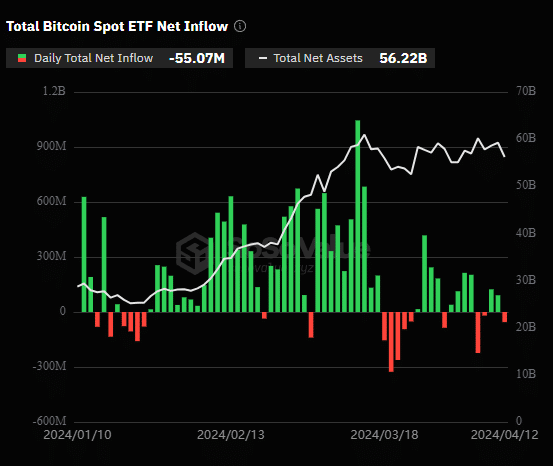

Spot Bitcoin ETFs, or exchange-traded funds, noticed a internet outflow of $55 million on Friday, April 12.

The info alerts a reversal after ETFs loved two consecutive days of influx value almost $215 million.

Bitcoin ETFs forward of halving

In keeping with knowledge from SoSo Value, the most important outflow on Friday got here from Grayscale’s GBTC, which noticed $166 million withdrawn.

GBTC continues to see giant outflows forward of the halving, because the ETF additionally shed $154.9 million on Monday, April 8.

Conversely, the most important influx on Friday got here from BlackRock IBIT, with the ETF attracting $111 million.

The impression of Friday’s outflow has been evident within the crypto market. Bitcoin misplaced almost 5% up to now 24 hours, dropping to $65,000. The general market adopted swimsuit, as almost $900 million was liquidated.

Bitcoin ETFs noticed three days of internet outflow final week, with a complete of $298.4 million in funds exiting from the market.

Regardless of the consecutive outflows from GBTC, Grayscale’s CEO, Michael Sonneshein, stays optimistic. Lately, Sonneshein emphasised that the withdrawals from GBTC have probably reached equilibrium. He believes that the outflow will considerably gradual as Grayscale decreases its Bitcoin ETF charges.

The continual outflows from the ETF market is also pushed by a pre-halving pullback. There’s a widespread anticipation that the Bitcoin halving usually results in a bigger bull marketplace for the most important cryptocurrency. So, a pullback happens when buyers begin taking income within the short-term and have a tendency to speculate once more when there’s a dip.

Nevertheless, it’s additionally probably that buyers are cautious concerning the halving not producing substantial rallies like earlier years, as Marathon Digital lately predicted that BTC has already reached its peak after the approval of ETFs earlier this 12 months.