Friday’s crypto market liquidation was largely triggered by heightening fears of battle between Iran and Israel, in line with QCP Capital.

Traditionally, geopolitical instability tends to drive buyers away from riskier property like cryptocurrencies, in search of security in additional steady investments.

This shift typically leads to sell-offs throughout danger asset lessons, as noticed within the current downturn.

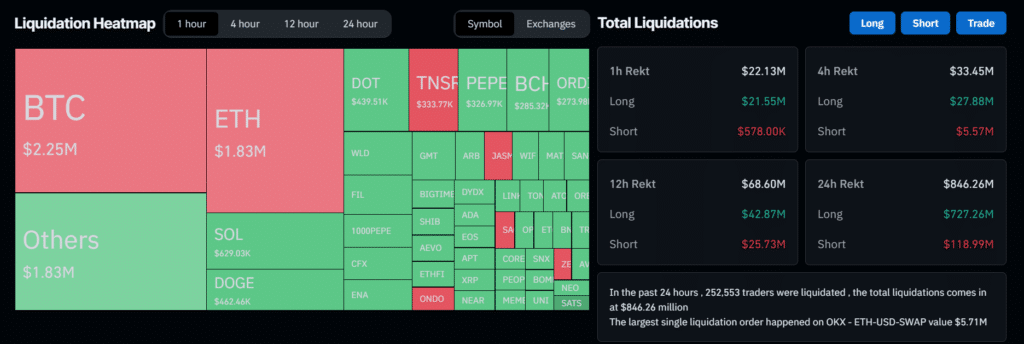

Within the final 24 hours, 261,054 merchants had been affected, and $860.82 million in property had been liquidated as the general crypto market cap plummeted almost 5%.

QCP Capital additionally noticed the ETH danger reversal indicator performed a major function within the liquidation. The agency famous on Friday that there was a notable draw back skew within the Ethereum danger reversal, which signaled a possible drop.

The chance reversal’s bearish skew signifies that merchants had been betting on ETH’s value dropping, a sentiment that probably stemmed from its use as a hedge.

This technical indicator proved correct, as ETH’s worth dropped over 5% to $3100. Sometimes, speculators holding lengthy positions in altcoins use ETH places to guard in opposition to downturns, making ETH costs significantly delicate to shifts in market sentiment.

The concern permeating the crypto markets was palpable, additional mirrored within the destructive swing of perpetual swap funding charges.

These charges plunged to over -40%, marking the deepest destructive funding this yr and signaling a robust bearish sentiment.

Moreover, this anxiousness crushed the ahead curve, with the entrance finish falling under 10%, highlighting a bleak short-term outlook for cryptocurrency costs.