Chinese language crypto merchants thrive regardless of the nation’s strict measures towards mining and digital foreign money transactions.

In 2020, China was an energetic participant within the cryptocurrency market, accounting for greater than 75% of the worldwide Bitcoin (BTC) mining hashrate. That each one modified after the federal government cracked down on all cryptocurrencies. Lately, although, rules appear to be barely relaxed as buyers search promising new belongings.

Chinese language Bitcoin merchants stay a major pressure in Bitcoin buying and selling. Their participation within the newest cryptocurrency sell-off is motivated by market value fluctuations quite than new constraints imposed by Chinese language regulators.

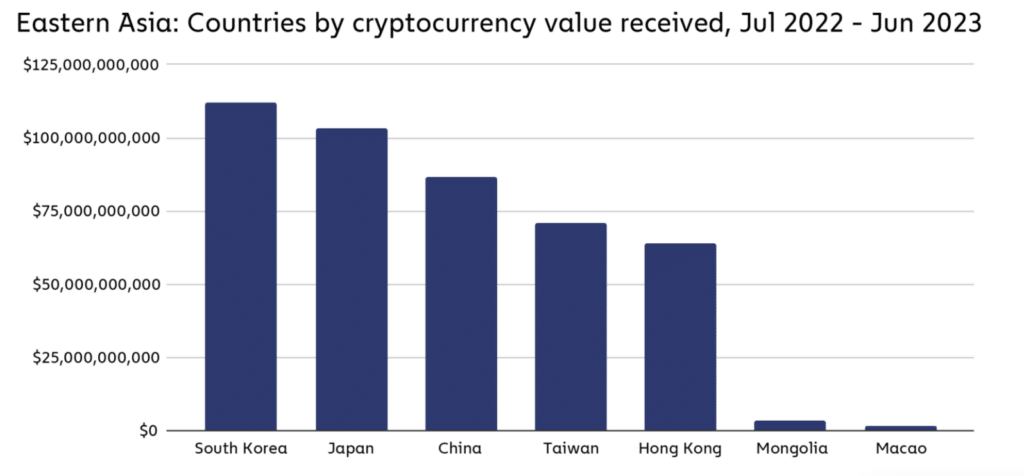

Chinese language commerce for billions of {dollars} regardless of the ban

In response to Chainalysis, between July 2022 and June 2023, the Chinese language cryptocurrency market processed $86.4 billion in crypto transaction quantity. Massive retail transactions starting from $10,000 to $1 million make up 3.6% of the full, practically double the worldwide common.

Chainalysis consultants say that latest occasions in Hong Kong have fueled hypothesis that the Chinese language authorities could also be warming as much as cryptocurrencies and that Hong Kong may grow to be a testing floor for these efforts.

How one can bypass restrictions

Regardless of a ban on cryptocurrency buying and selling in China since 2021, Reuters reports that losses within the Chinese language inventory market during the last three years have pushed buyers again to cryptocurrencies. Dylan Run, a monetary govt in Shanghai, refers to Bitcoin as “a protected haven, like gold.”

In early 2023, noticing the downturn in China’s economic system and inventory market, Run began shifting a few of his funds into cryptocurrencies.

Although formally banned, cryptocurrency buying and selling stays accessible in China. Residents proceed to commerce digital tokens like Bitcoin on platforms equivalent to OKX and Binance or via over-the-counter strategies. An alternative choice is utilizing overseas financial institution accounts to purchase cryptocurrencies.

Number of fee strategies

With China’s cryptocurrency ban, buyers have grow to be extra artistic in managing their funds. As Reuters studies, Dylan Run, as an example, used financial institution playing cards from small rural banks to buy cryptocurrencies via unofficial sellers. He stored transactions below 50,000 yuan ($6,978) to keep away from drawing consideration from authorities.

Merchants have discovered numerous methods to switch cryptocurrencies, together with money or financial institution transfers. Cities like Chengdu and Yunnan have grow to be hubs for these merchants, providing a respite from the central authorities’s scrutiny, which is concentrated elsewhere.

In response to the Wall Road Journal, Chinese language buyers additionally turn to social networks like WeChat and Telegram for cryptocurrency buying and selling. They use these platforms to attach with others in specialised teams, bypassing the necessity for centralized exchanges.

In rural areas, the place enforcement is much less strict, the bodily buying and selling of digital belongings is prevalent. Merchants typically meet in public locations equivalent to cafes or laundromats to trade pockets addresses or conduct transactions in money or via banks.

Hong Kong

Hong Kong additionally affords financial savings alternatives as Chinese language residents are given an annual overseas foreign money buy of $50,000, which some use to purchase cryptocurrencies within the Hong Kong market.

As China’s $135.7 trillion actual property market continues to battle, extra residents might quickly flip to cryptocurrencies to catch up. The nation’s property market ended 2023 with the steepest fall in new residence costs in practically 9 years, regardless of authorities efforts to prop up a sector as soon as a crucial driver of the world’s second-largest economic system.

One nameless Hong Kong crypto trade govt advised Reuters they see mainland buyers coming into the cryptocurrency market virtually day by day. China’s financial downturn “has made funding on the mainland dangerous, unsure and disappointing, so folks want to allocate belongings offshore.”

And it’s not simply retail buyers. Chinese language brokers and different monetary establishments have additionally begun to enter the cryptocurrency market. The necessity for development alternatives on the mainland has pushed them to discover the cryptocurrency enterprise in Hong Kong.

“If you happen to’re a Chinese language dealer dealing with a weak inventory market, weak IPO demand, and shrinking different companies, you want a development story to inform your shareholders and board of administrators.”

Nameless Hong Kong crypto trade govt

Fintech platforms equivalent to Ant Group’s Alipay and Tencent’s WeChat Pay have additionally made it simpler for residents to put money into cryptocurrencies. They permit customers to transform yuan into steady digital cash at sellers, which might then be used to commerce cryptocurrencies on numerous exchanges.

In response to Chainalysis, the more and more nearer relationship between China and Hong Kong has some speculating that Hong Kong’s rising standing as a crypto hub may sign that the Chinese language authorities is altering course on digital belongings or not less than turning into extra open to crypto initiatives.

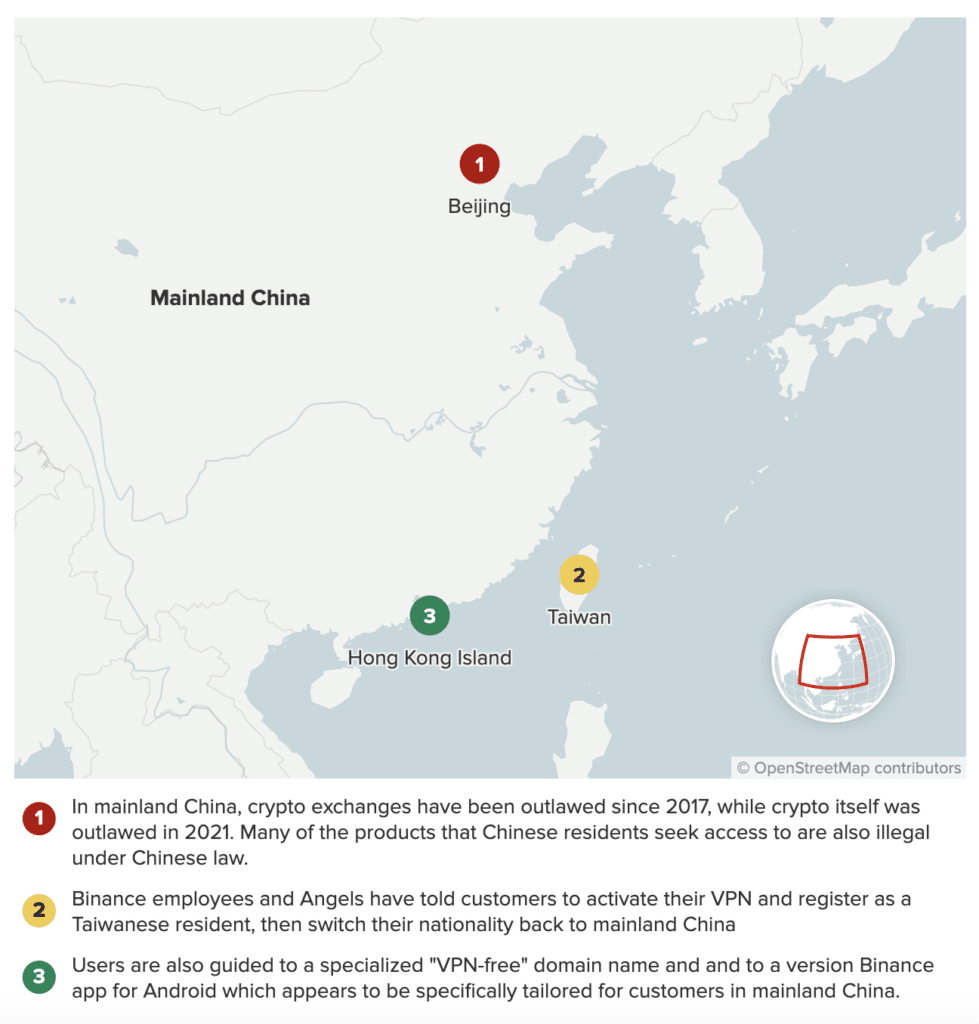

False geolocation

Some customers saved their accounts on buying and selling platforms and continued to make use of them after the ban, bypassing geo-restrictions utilizing a VPN. In Could 2023 alone, the turnover of Chinese language merchants on Binance reached $90 billion – roughly 20% of the full. In response to CNBC, trade workers suggested customers from China to evade KYC checks.

Final yr’s report highlighted that some merchants opened crypto accounts with pretend paperwork, together with citizenship.

By offering false residence and financial institution particulars, these merchants search to bypass Know Your Buyer (KYC) protocols and register accounts violating regulatory measures. This unconventional strategy to cryptocurrency buying and selling starkly contrasts the nation’s strict regulatory surroundings.

China is on the lookout for salvation in crypto

The surge in Bitcoin and different cryptocurrencies comes from underperforming conventional Chinese language investments. The crackdown on the actual property sector and the continued financial transition have made standard funding avenues equivalent to shares and actual property much less enticing. Certainly, a dominant state-owned enterprise sector, opaque governance, regulatory uncertainty, and a weak credit standing system pose important financial challenges.

Present situations have accelerated the inventory market crash and raised issues about the way forward for China’s financial surroundings. Cryptocurrencies are, due to this fact, rising as a viable various, providing a semblance of stability and development potential amid the turbulence of the Chinese language economic system. Chinese language merchants’ rise in cryptocurrency funding is a telling signal of the occasions, reflecting a strategic shift in response to a altering financial and regulatory surroundings.